Financial Services Marketing Essay Sample,

Managing perceived risk for credit card purchase through supplementary services

Journal of Financial Services Marketing

INTRODUCTION

Services are intangible dominant products

that cannot be physically possessed. This very

nature of services is represented through

unique characteristics of services, viz.,

intangibility, inseparability of production and

consumption, heterogeneity, perishability and

lack of ownership. 1,2 Further, the traditional

four P marketing-mix is also augmented for

services with the addition of three more Ps

— people, physical evidence and the process. 3

Within the existing literature of services,

efforts have been put forth to understand the

role of all Ps with a vast scope to explore

further. The present study focuses on

understanding the role of supplementary

services (component of fi rst P — Service

Product of the marketing-mix) towards

reducing / managing perceived risk in the

purchase of credit card services in India.

Credit cards come under the umbrella of

fi nancial services. While fi nancial services are

similar to other services in respect of a

common knowledge base, they are considered

relatively complex in nature in comparison to

other services. This is due to the nature of

fi nancial services that are not only intangible

Managing perceived risk for

credit card purchase through

supplementary services

Received (in revised form): 24th July, 2007

Anita Goyal

is presently working as Associate Professor (Marketing) at Management Development Institute, Gurgaon, India. She has 12 years of

experience in academics after being a year in industry. She has an MBA in Marketing Management from University of Poona, India, and

a PhD in Services Marketing and Consumer Behaviour from Jamia Millia Islamia, New Delhi, India. She has exposure of teaching and

supervising projects at the international level. MDI, Gurgaon, where she is presently working, is a renowned B School getting a consistent

ranking among the top fi ve league in India.http://www.ukassignment.org/liuxuezuoyedaixie/xinxilanzuoye/

Abstract The present study aims to understand the signifi cance of supplementary services

as nonpersonal sources of information to consumers to handle perceived risk associated with

the purchase of credit card services. The impact of supplementary services is particularly

studied towards functional risk and psychological risk. The study is based on primary data

collected by a survey with the help of a questionnaire administered through personal

interviews. It is found that supplementary services can play a signifi cant role in controlling#p#分页标题#e#

functional and psychological perceived risk associated with credit card services. Marketers of

credit cards can enhance the value of services to customers and can thus enhance purchase

possibilities by reducing perceived risk through supplementary services that are controllable.

Perceived risk in fi nancial services marketing is an important factor from the consumers ’ point

of view for purchase decisions and is also an issue of signifi cance to service marketers. It is

an original attempt to examine the relationship between perceived risk and supplementary

services.

Journal of Financial Services Marketing (2008) 12, 331 – 345. doi: 10.1057/palgrave.fsm.4760086

Keywords Supplementary services , perceived risk , credit cards , services marketing , fi nancial

services

Goyal

332 Journal of Financial Services Marketing Vol. 12, 4 331–345 © 2008 Palgrave Macmillan Ltd 1363-0539 $30.00

in their physical form; they are also intangible

from a mental point of view as they are not

easily defi ned and may be diffi cult to

understand. 4 Owing to a lack of complete

understanding, uncertainty of purchase

outcome and money involved, consumers

perceive risk in the purchase of fi nancial

services. As a result, pre-purchase perceived

risk with fi nancial services is of concern for

marketers because it is diffi cult for consumers

to evaluate the services prior to purchase.

According to Laroche et al ., 5 the mental

dimension of intangibility is the most

correlated dimension with perceived risk

than the other two dimensions of

intangibility, namely physical intangibility and

generality. Their research has also indicated

that the same is true even when the

customer has knowledge of and involvement

in the purchase. Thus, the challenge for

marketers is to make their offers mentally

tangible. One exploratory study 6 fi nds that

purchasing e-banking services is perceived to

be riskier than purchasing traditional banking

services.

In terms of the credit card as a service

product, every marketer has to provide the

revolving credit facility (core service) without

which the service product would not be

called a credit card. It means that one can

pay the amount spent through the credit card

in installments (as per the conditions

specifi ed by the bank). In addition to the

core service, there are a number of additional

features, that is, supplementary services viz.

credit card with ATM facility and cash

withdrawal, offered by credit card marketers

for enhancing the value of services. This

study looks at these supplementary services,

which might be considered a nonpersonal

source of information, as a tool to handle the

perceived risk associated with credit cards.#p#分页标题#e#

Whereas the existing research shows the

consumer reliance on personal sources of

information to reduce perceived risk with

services purchases, 7 this paper is an original

attempt to study the relationship between

supplementary services and perceived risk.

This study may help marketers to meet the

challenges associated with perceived risk

effectively.

The credit card is one of the known forms

of fi nancial cards in India. The last decade has

seen a signifi cant rise in the number of credit

card users. According to a study commissioned

by Visa International and conducted by the

National Council of Applied Economic

Research, India, payment cards in India (both

credit and debit cards) have grown 55 per

cent annually in the last seven years — from

3m in 1998 to 44m in 2004. 8 Credit card

usage and penetration in India is still low,

however, in comparison to growing affl uence

levels and consumer acceptance of the

payment card system. The average spending

through credit cards by an Indian consumer

is estimated at Rs. 24,000 per annum

(ie US $ 533, considering US $ 1 = Rs. 45). 9 At

the same time, in the present scenario, the

expected growth rate of credit card business

in India is 25 – 30 per cent. 9,10 Thus, the

challenge for the credit card companies is not

only to attract users but also to increase

spending by existing card holders.

LITERATURE REVIEW

The study deals with different issues of

perceived risk, supplementary services and

credit card marketing, which are as follows:

Perceived risk

Consumers make decisions regarding what

goods or services to buy and where to

buy them. The outcomes (or consequences)

of such decisions are often uncertain and

the consumer perceives some degree of

‘ risk ’ in making a purchase decision. This

perceived risk 11 is defi ned as the uncertainty

that consumers face when they cannot

foresee the consequences of their purchase

decisions. The degree of risk that consumers

perceive and their own tolerance for risk

taking are factors that infl uence their

purchase strategies. It is important, however,

Managing perceived risk for credit card purchase

© 2008 Palgrave Macmillan Ltd 1363-0539 $30.00 Vol. 12, 4 331–345 Journal of Financial Services Marketing 333

that consumers are infl uenced by risk that

they perceive, irrespective of its actual

existence.

The major types of risk 11 that consumers

may perceive when making product purchase

decisions include functional risk (risk that the

product will not perform as expected),

physical risk (risk to self and to others that

the product may pose), fi nancial risk (risk

that the product will not be worth its cost),#p#分页标题#e#

social risk (risk that a poor product choice

may result in social embarrassment),

psychological risk (risk that a poor product

choice will bruise the consumer ’ s ego) and

time risk (risk that the time spent in product

search may be wasted if the product does not

perform as expected). Perceived risk is

considered a consumer characteristic as well

as a product characteristic as it may be due

to various factors either associated with

personal or product features. 12 – 14

Although there is always some element of

risk that accompanies all purchases, there are

conceptual frameworks 15,16 and empirical

evidence 17,18 that suggest that more risk is

associated with services than goods. It is

identifi ed that services are perceived to be

riskier than goods for all types of perceived

risk. 19 This is due to the experiential nature

of services and its characteristics, which result

in a decrease in pre-purchase information for

the evaluation of service products. Research 20

indicates that a decrease in the amount

and / or quality of information is usually

accompanied by a concomitant increase in

perceived risk. As a result, consumers seek

information from different sources when

faced with risk or uncertainty. 21,22 In highrisk

situations, consumers are likely to engage

in complex information search and

evaluation, and in low-risk situations, they are

likely to use very simple search and

evaluation tactics. The degree of perceived

risk infl uences pre-purchase search for the

decision process. 7,12 – 14

During a pre-purchase search 23 for making

a purchase decision, consumers fi rst tend to

recollect the relevant information from

memory and past experiences (internal

search). If the consumer has had no prior

experience or is unable to reach a solution

through internal search, then the consumer

may engage in an extensive search of the

outside environment for useful information

to make a choice. The information search

focused on external information relevant to

solving the problem is called external search.

This external search includes personal sources

such as friends, family, neighbours and

relatives; independent sources such as

magazines, consumer groups and government

agencies; and marketing sources such as sales

personnel and advertising. Internal

information is the primary source used by

most consumers most of the time. Even that

information in long-term memory, however,

was initially obtained from external sources.

Research evidence shows that as perceived

risk associated with the purchase increases,

the use of personal sources is the most

preferred source of external information 7,24

and the credibility of personal sources#p#分页标题#e#

encourages their use in situations of high

perceived risk. 25 Murray 18 has shown

empirically that in the case of services,

consumers engage in more word-of-mouth

and personal sources of information as a

risk-coping strategy.

Owing to the dominance of experience

and credence qualities in services, consumers

seem to seek and rely more on information

from personal sources than nonpersonal

sources while evaluating services prior to

purchase. 26 According to Freiden and

Goldsmith 27 marketing originated messages — a

nonpersonal source of information — are

found to be of limited direct value in

consumer decisions toward professional

services, which consist mainly of credence

qualities.http://www.ukassignment.org/liuxuezuoyedaixie/xinxilanzuoye/

The focus of the present study is to

understand the role of supplementary

services, as a nonpersonal source of

information being offered and communicated

by the marketer, towards perceived risk in

credit card purchase.

Goyal

334 Journal of Financial Services Marketing Vol. 12, 4 331–345 © 2008 Palgrave Macmillan Ltd 1363-0539 $30.00

Supplementary services

The service as a product is essentially

described as a package or bundle of different

services, tangibles and intangibles, which all

together form the total product. The package

is divided into two main categories: the fi rst

one is the main service, which is called the

‘ core service ’ 28,29 or ‘ substantive service ’ . The

other one is ‘ auxiliary services ’ or ‘ extras ’ ,

which are often referred to as ‘ peripherals ’ or

‘ peripheral services ’ . 29 These are also known

as supplementary services. 30,31

The core service is the basic value

provided by the service product. It is the

reason to purchase or consume services. This

is the reason for which any company is in

business too. Supplementary services are those

that facilitate and enhance use of the core

services. These are services other than core

that companies offer to their customers to

give additional value to their products or to

encourage customer loyalty. 30,31 Augmenting

the service by building extras into the basic

service is also considered as a relationship

marketing strategy. 32 Using ‘ extras ’ as part of

the service product in order to differentiate

the service has also been discussed by

Levitt. 33 In this way, the service is

differentiated from those of the competitors.

Having been offered these extras, the

customers fi nd them attractive as well as

benefi cial and therefore, prefer doing business

with the company that supplies them.

Gronroos 34 has identifi ed the need to#p#分页标题#e#

breakdown supplementary services into

facilitating services and supporting services

from the managerial view to develop the

service package effectively. Facilitating

services are mandatory to the service product.

If they are left out, the service package

collapses. At the same time, these can be

designed in such a way that they differ from

the facilitating services of competitors and

can become a competitive tool and, thus,

help to differentiate the service offer. For

example, bill statements and swipe machines

are facilitating services in the case of credit

cards. On the other hand, if supporting

services are lacking, the core service can be

used nevertheless. The total service package,

however, may be less attractive and perhaps

less competitive. Thus, supporting services do

not facilitate the consumption or use of the

core service, but are used to increase the

value and / or to differentiate the service from

the competitors. For example, ATM access

and cash withdrawal outside the credit limit

can be considered supporting services /

supplementary services in credit cards.

Related research shows 35 that facilitating

services are considered by consumers while

deciding for a credit card purchase and

supplementary services are signifi cant in

providing help to consumers for pre-purchase

evaluation of credit cards and to make credit

card purchase decisions in the Indian

environment.

Credit card marketing

Previous research in the area of credit card

marketing and consumer behaviour covers

issues related to the identifi cation of ways

and means to face the saturation situation of

credit card markets. There are studies on the

identifi cation and analysis of consumers ’ use

patterns and to explore various opportunities

to grow and expand credit card business.

To identify an opportunity due to near

saturation of Asian and Hispanic markets in

USA, consumers were identifi ed with their

credit card usage patterns towards rent

payments, clothing and shoe purchases. 36

Duffy 37 identifi ed the marketing strategies

for introducing affi nity cards and providing

value-added features like frequent user

programmes, to hold on to existing card

holders and to attract new ones due to the

maturing credit card market.

Researchers have considered the role of

demographic factors towards credit card

marketing like, the relationship between age

and knowledge of credit cards among

students. 38 Kara et al . 39 identifi ed and

analysed the various factors, namely brand

Managing perceived risk for credit card purchase

© 2008 Palgrave Macmillan Ltd 1363-0539 $30.00 Vol. 12, 4 331–345 Journal of Financial Services Marketing 335#p#分页标题#e#

name, credit line, type of card, annual fee and

interest, to develop marketing strategies for

the potential youth market. The important

factors infl uencing credit card selection

behaviour of college students were

determined. Mathur and Moschis 40 studied

the market of older Americans to understand

their use of credit cards on the basis of

expenditures, lifestyles and circumstances.

Chan 41 identifi ed income as an important

variable to infl uence the credit card usage rate.

The research also indicated a positive

relationship between the attitude of credit card

holders and usage rate. Meidan and Dimitris 42

investigated the main dimensions and

attributes that Greek card holders consider

important while selecting a credit card or a

charge card. These factors include convenience

to use the card in Greece, security, economy,

prestige and shopping abroad. Other studies

are related to the manufacture of plastic

cards, 43 affi nity cards, 44,45 retail credit cards 46

and other issues of card market that are not of

relevance to this particular study.

Thus, the review of existing knowledge

shows that in the case of services, consumers

depend more on personal sources of

information rather than on nonpersonal

sources of information in order to evaluate

service product prior to purchase and to

handle the perceived risk. The present study

investigates whether supplementary services

available with a credit card (as an external:

nonpersonal source of information being

offered by the marketer) help in reducing the

perceived risk, especially in terms of

functional risk and psychological risk that are

identifi ed to be associated with the credit

card purchase. It also analyses whether age

and gender, as demographic factors, have any

infl uence on consumers ’ perceptions of

considering supplementary services as a

means of reducing perceived risk.

OBJECTIVES

1. To understand the perception of consumers

regarding the role of supplementary services

towards functional and psychological

perceived risks associated with credit card

services.

2. To understand the function of age and

gender categories towards objective one.

Objective 1 is to determine whether

consumers can perceive the functional

viability of the supplementary services offered

with credit cards (functional risk) and also

whether consumers can be satisfi ed with

their credit card purchase decision based on

supplementary services (psychological risk).

Objective 2 is the extension of objective 1,

where an attempt has been made to analyse

the impact of age and gender on consumer

perceptions of supplementary services towards

functional and psychological perceived risks#p#分页标题#e#

with credit card purchases. As per the

previous studies on credit cards, consumption

patterns may differ on the basis of the age

factor. Further, the changing role of women

in India in terms of working status and of

becoming fi nancially independent provide a

basis to consider gender as another

demographic factor.

METHODOLOGY

The research study is based on primary data

collected through a survey with the help of a

questionnaire. The questionnaire was

administered by meeting the respondents on

a one-to-one basis primarily in malls and

shopping complexes (place of usage of credit

card).

With regard to sampling design, the

sampling unit was derived from a two-stage

sampling process. First, a sample of six banks

was identifi ed as they provide credit cards

and similar types of supplementary services.

Then, within these six selected banks a

quota sample of credit card holders was

taken. Two control characteristics were taken

care of — credit card holders from the

identifi ed banks and gender of the credit card

holders. As per the fi rst characteristic, 720

respondents were taken from the identifi ed

Goyal

336 Journal of Financial Services Marketing Vol. 12, 4 331–345 © 2008 Palgrave Macmillan Ltd 1363-0539 $30.00

banks (120 respondents from each bank).

In relation to the second characteristic,

the sample size for each individual bank

was determined on a proportionate basis

(60 male respondents and 60 female

respondents from each identifi ed bank).

Thus, there are a total of 360 male

respondents and 360 female respondents. For

the age factor of the respondents, with

respect to the second objective of the study,

actual responses are taken for each age

group, that is, 18 – 24, 25 – 34, 35 – 44, 45 – 54

and 50 + years as 239, 200, 115, 116 and 50,

respectively. A large sample was considered to

ensure the adequate coverage of the

characteristics including banks, gender

categories and age categories.

The research plan for the study has taken

into consideration the following aspects: fi rst,

the perception of consumers regarding the

role of supplementary services is studied only

with reference to functional and

psychological risk — as revealed through

pre-research interviews with selected service

providers and customers. Secondly, the

supplementary services identifi ed with credit

cards include services of ‘ credit card

acceptability for buying railway / airline tickets

and for buying petrol ’ . This is because credit

card companies in India still have to tie up

with operators for the acceptance of their

card. Thirdly, equal sample sizes of male and#p#分页标题#e#

female respondents are taken for the study to

draw unbiased inferences about gender

perceptions towards the objective. In other

words, with equal representation of both

genders in the sample — similarity or

differences in gender perception can be relied

upon. Fourthly, in the Indian context, many

people in the 55 + years of age group do not

make purchases on credit. They live with

whatever they can purchase within their

income in hand and consider this as a matter

of pride (shared by the respondents of the

55 + year age group during the questionnaire

development stage). This could be the reason

why only 50 people responded in the age

group of 55 + years.

DEVELOPMENT OF CONSTRUCTS

FOR MEASURING ASSOCIATION

BETWEEN PERCEIVED RISK AND

SUPPLEMENTARY SERVICES

As per Dowling, 47 the perceived risk

construct has been conceptualised and

operationalised at different levels of generality

or abstraction. Low-level measures focus on

risk perception of (the attributes of) a single

product. Medium-level measures focus on the

product category and high-level measures

resemble a personality trait. Dowling 47

believes that perceived risk at a low level of

abstraction should be a more powerful

predictor of consumer behaviour because

fewer other variables intervene in between

the risk and behaviour. Dowling and Staelin 48

develop the model of perceived risk and

risk-handling activity based on a low level of

abstraction using attributes of a product

(ie, dress — a general product category).

Mitchell 49 analyses the various models

towards perceived risk measurement and

shows a high reliability of the model,

developed by Dowling and Staelin, 48 based

on product attributes.

Further, Dowling 47 indicates that the set of

adverse consequences of the product

attributes chosen is part of the basic structure

of any perceived risk measure because it

measures the presence of perceived risk and

is of prime theoretical importance. No

empirical evidences are available, however, for

the same. Goyal 35 shows that consumers

consider supplementary services for making

credit card purchase decisions and also have

positive attitudes towards supplementary

services in post-purchase evaluation. It further

identifi es a signifi cant association between

consideration of supplementary services

before purchase and the importance of

supplementary services perceived after

purchase.

The present study takes into consideration

the low level of measures as focused on the

attributes (supplementary services) of a single

product (credit card). As per the inputs given

Managing perceived risk for credit card purchase

© 2008 Palgrave Macmillan Ltd 1363-0539 $30.00 Vol. 12, 4 331–345 Journal of Financial Services Marketing 337#p#分页标题#e#

by the experts in the related fi eld of study

(viz., service providers, academicians) and the

stated objectives of the study, the construct

was not based on the perceived adverse

consequences of the attributes but rather on

ascertaining whether the attributes

(supplementary services with credit cards)

help in eliminating the perceived risk.

Two constructs of ten statements each

were developed ( Appendix A ): one for

measuring association between supplementary

services and functional risk and the other for

measuring the association between

supplementary services and psychological risk.

These two constructs were put to experts ’

evaluation and after consolidating the experts ’

advice, fi ve statements were identifi ed under

each construct for fi nal collection of data. In

the absence of any pre-developed validated

scales, experts ’ opinions were identifi ed as a

reliable method to achieve an evaluation.

Consumer perception is recorded using a

fi ve-point scale.

ANALYSIS

Objective 1

Table 1 reveals that on average a signifi cant

number of respondents, that is, 79.26 per

cent agree (32.94 per cent strongly agree and

46.32 per cent agree) with the idea that

supplementary services provide operational

value. In other words, consumers perceive

functional viability of the additional benefi ts

with the card. Only 11.7 per cent of

respondents disagree and a very small

percentage of respondents, that is, 1.82 per

cent strongly disagree with the supporting

nature of supplementary services towards the

functional aspect of credit cards.

Individual analysis of statements gives the

clear understanding that respondents have

perceived the maximum functional utility of

those supplementary service features that are

associated with providing fi nancial benefi ts.

Importance has been given to ATM access,

cash advance and cash withdrawal facility

Table 1 Consumer perception regarding supplementary services in managing functional risk with credit cards

S.N. Statements Response

mean

Chi-square test Responses on fi ve-point scale (%)

Chisquare*

d.f. Signifi cance Strongly

agree

Agree Undecided Disagree Strongly

disagree

F1 ATM access, cash advance, and cash withdrawal and

other facilities help to meet my fi nancial requirements

effectively.

4.04 474.847 4 0.000 42.5 36.5 6.4 11.3 3.3

F2 I do not face the problem of inadequate cash because of

ATM access, cash advance, and cash withdrawal

facilities with my credit card.

3.92 534.958 4 0.000 28.9 49.6 8.8 10.6 2.2

F3 Through add-on card other family members can also

use the credit card.

3.98 821.569 4 0.000 24.4 59.7 6.4 8.8 0.7

F4 Buying airline/railway tickets by using credit card at#p#分页标题#e#

special counters save time.

3.94 432.694 4 0.000 36.8 38.9 6.5 17.1 0.7

F5 Additional facilities with credit card increase its usage

value.

3.96 510.236 4 0.000 32.1 46.9 8.1 10.7 2.2

Average of percentages 32.94 46.32 7.24 11.7 1.82

*Chi-square value is signifi cant at the 0.05 level

* * Total respondents=720

Goyal

338 Journal of Financial Services Marketing Vol. 12, 4 331–345 © 2008 Palgrave Macmillan Ltd 1363-0539 $30.00

(F1 — mean 4.04), add-on card features

(F3 — mean 3.98), as these features meet the

fi nancial requirement. Next in the order comes

the facility of card acceptance at railway / airlines

ticket counters (F4 — mean 3.94).

Further, chi-square values are signifi cant

for all the statements ( p < 0.05). Thus, it can

be inferred that there are signifi cant

differences in the frequency of perceptions

towards the statements indicating the

functional utility of supplementary services

available with credit cards. The examination

of responses, as stated above, also reveals that

supplementary services play a signifi cant role

in controlling the functional risk via

performing the functional capability of credit

cards. The results show that people largely

agree with the statements.

On average, Table 2 shows that 46.82 per

cent of respondents agree and 23.82 per cent

strongly agree that supplementary services

with credit cards help them to take care of

psychological risk. In other words,

supplementary services with credit cards give

them satisfaction in making the right

purchase decision. Only 4.52 per cent of

respondents strongly disagree with the belief

and 13.86 per cent responses are in

disagreement. The remaining 11.02 per cent

respondents gave no decisive view.

A closer look at the responses for

statement P5 (mean 4. 090) indicates that

respondents have a high positive perception

towards making a credit card purchase

decision with additional facilities, which

shows that respondents feel satisfaction by

keeping additional facilities as the basis for

making purchase decisions for credit cards.

84.5 per cent of responses show agreement

with statement P4 (mean 4.10) that zero /

limited lost card liability as a supplementary

feature gives a sense of security to the

consumer. There is also a high perception for

statement P1 (83.5 per cent and mean 3.95),

which reveals that consumers feel good as the

add-on card facility gives independence to

family members to make purchases as and

when required and thus helps one to take care

Table 2 Consumer perception regarding supplementary services in managing psychological risk with credit cards

S. N. Statements Response

mean#p#分页标题#e#

Chi-square test Responses on fi ve-point scale (%)

Chisquare*

d.f. Signifi cance Strongly

agree

Agree Undecided Disagree Strongly

disagree

P1 My family members are not dependent on me to

use credit card due to add-on card availability.

3.95 823.097 4 0.000 23.1 60.4 7.1 6.9 2.5

P2 Additional facilities like ATM access, cash

withdrawal etc. with credit card provides me a

sense of security.

3.64 384.389 4 0.000 17.6 46.3 22.5 9.9 3.8

P3 I prefer to have recognition and attention, if

purchases are made through credit card.

2.79 198.167 4 0.000 17.5 16.8 9.3 40.1 16.3

P4 I feel myself in safe hands due to zero/limited lost

card liability.

4.10 402.244 3 0.000 32.1 52.4 9.3 6.3 —

P5 I feel good about my decision to have additional

facilities with my credit card.

4.09 518.033 3 0.000 28.8 58.2 6.9 6.1 —

Average of percentages 23.82 46.82 11.02 13.86 4.52

*Chi-square value is signifi cant at the 0.05 level

* * Total respondents=720

Managing perceived risk for credit card purchase

© 2008 Palgrave Macmillan Ltd 1363-0539 $30.00 Vol. 12, 4 331–345 Journal of Financial Services Marketing 339

of near and dear ones. The least preference is

for statement P3 (mean 2.97), which indicates

that people do not use credit cards to gain

attention and to show their status.

An analysis of the responses suggests that

supplementary services are able to handle

psychological risk with credit card holders.

The chi-square values are also signifi cant for

all the statements ( p < 0.05). This infers that

there are signifi cant differences in the

frequency of perceptions towards the

statements indicating the psychological utility

of supplementary services with credit cards.

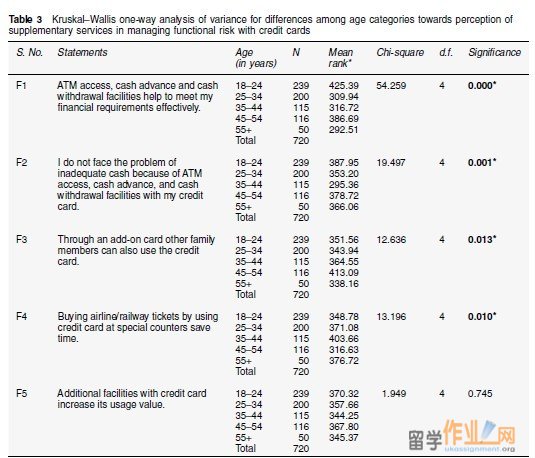

Objective 2

The perception of consumers, according to

their age groups, towards the role of

supplementary services for controlling the

functional risk perceived to be associated

with credit cards is evaluated through the

analysis of Table 3 with the Kruskal – Wallis

one-way analysis of variance test. The chisquare

values show that there are signifi cant

differences in perception ( p < 0.05) among

respondents belonging to different age

categories. The age group of 18 – 24 years sees

more utility for ATM access, cash withdrawal

facilities (mean rank 425.39 for statement F1

and 387.95 for statement F2), followed by

the age group of 45 – 54 years (mean rank

386.69 for statement F1 and 378.72 for

statement F2). The age group of 45 – 54 years

gives more utility to add-on cards, followed

by the 35 – 44 age group. Buying airline /

railway tickets are found to be of maximum

Table 3 Kruskal – Wallis one-way analysis of variance for differences among age categories towards perception of#p#分页标题#e#

supplementary services in managing functional risk with credit cards

S. No. Statements Age

(in years)

N Meanhttp://www.ukassignment.org/liuxuezuoyedaixie/xinxilanzuoye/

rank*

Chi-square d.f. Signifi cance

F1 ATM access, cash advance and cash

withdrawal facilities help to meet my

fi nancial requirements effectively.

18 – 24

25 – 34

35 – 44

45 – 54

55+

Total

239

200

115

116

50

720

425.39

309.94

316.72

386.69

292.51

54.259

4 0.000*

F2 I do not face the problem of

inadequate cash because of ATM

access, cash advance, and cash

withdrawal facilities with my credit

card.

18 – 24

25 – 34

35 – 44

45 – 54

55+

Total

239

200

115

116

50

720

387.95

353.20

295.36

378.72

366.06

19.497

4

0.001*

F3 Through an add-on card other family

members can also use the credit

card.

18 – 24

25 – 34

35 – 44

45 – 54

55+

Total

239

200

115

116

50

720

351.56

343.94

364.55

413.09

338.16

12.636

4

0.013*

F4 Buying airline/railway tickets by using

credit card at special counters save

time.

18 – 24

25 – 34

35 – 44

45 – 54

55+

Total

239

200

115

116

50

720

348.78

371.08

403.66

316.63

376.72

13.196

4

0.010*

F5 Additional facilities with credit card

increase its usage value.

18 – 24

25 – 34

35 – 44

45 – 54

55+

Total

239

200

115

116

50

720

370.32

357.66

344.25

367.80

345.37

1.949

4

0.745

*Mean Rank difference is signifi cant at the 0.05 level

Goyal

340 Journal of Financial Services Marketing Vol. 12, 4 331–345 © 2008 Palgrave Macmillan Ltd 1363-0539 $30.00

utility by the age group 35 – 44 years,

followed by the age group 55 + years.

The chi-square value for statement F5

is not signifi cant ( p >0.05). As per the

statement F5, however, the result shows

that all age group respondents see the

functional value of supplementary services

with credit cards as they have near equal

preference for the additional facilities. Thus,

results infer that different age categories

have preference for different supplementary

services to fulfi l their functional needs

from credit cards.

Perception of consumers, on the basis of#p#分页标题#e#

their age groups, towards the role of

supplementary services for handling the

psychological risk perceived to be associated

with credit card services is analysed with the

help of Table 4 with the Kruskal – Wallishttp://www.ukassignment.org/liuxuezuoyedaixie/xinxilanzuoye/

one-way analysis of variance test. Examination

of the chi-square value indicates that the age

groups differ signifi cantly ( p < 0.05) in their

perception towards statements P2, P3 and P5.

For statements P2 and P3, the 55 + year age

group perceives more psychological value,

followed by the age group 35 – 44 years and

25 – 34 years, respectively. For statement P5,

the age group 18 – 24 years prefers additional

benefi ts with credit cards, followed by the

age group 45 – 54 years.

It can be inferred that respondents in

the age group of 55 + years show a more

Table 4 Kruskal – Wallis one-way analysis of variance for differences among age categories towards perception of

supplementary services in managing psychological risk with credit cards

S. No. Statements Age

(in years)

N Mean

rank*

Chi-square d.f. Signifi cance

P1 My family members are not

dependent on me to use credit card

due to add-on card availability.

18 – 24

25 – 34

35 – 44

45 – 54

55+

Total

239

200

115

116

50

720

342.19

370.92

382.46

357.48

362.89

4.784

4

0.310

P2 Additional facilities like ATM

access, cash withdrawal, etc. with

credit card provides me with a

sense of security.

18 – 24

25 – 34

35 – 44

45 – 54

55+

Total

239

200

115

116

50

720

331.22

358.72

382.14

358.56

462.28

20.356

4

0.000*

P3 I prefer to have recognition and

attention, if purchases are made

through credit card.

18 – 24

25 – 34

35 – 44

45 – 54

55+

Total

239

200

115

116

50

720

346.19

394.14

362.78

293.90

443.63

28.539

4

0.000*

P4 I feel myself in safe hands due to

zero/limited lost card liability.

18 – 24

25 – 34

35 – 44

45 – 54

55+

Total

239

200

115

116

50

720

372.92

356.03

367.12

331.55

370.96

4.176

4

0.383

P5 I feel good about my decision to

have additional facilities with my

credit card.

18 – 24

25 – 34

35 – 44

45 – 54#p#分页标题#e#

55+

Total

239

200

115

116

50

720

400.47

352.09

256.02

389.82

375.40

52.317

4

0.000*

*Mean Rank difference is signifi cant at the 0.05 level

Managing perceived risk for credit card purchase

© 2008 Palgrave Macmillan Ltd 1363-0539 $30.00 Vol. 12, 4 331–345 Journal of Financial Services Marketing 341

Table 5 Mann – Whitney U -Test for differences among gender categories towards perception of supplementary

services in managing functional risk with credit cards

S. No. Statements Gender

category

N Mean

rank*

U Z Signifi cance

F1 ATM access, cash

advance and cash

withdrawal and other

facilities help to meet my

fi nancial requirements

effectively.

Male

Female

Total

360

360

720

337.00

384.00

56341.50

− 3.245

0.001*

F2 I do not face the

problem of inadequate

cash because of ATM

access, cash advance and

cash withdrawal facilities

with my credit card.

Male

Female

Total

360

360

720

338.14

382.86

56751.00

− 3.125

0.002*

F3 Through an add-on card

other family members can

also use the credit card.

Male

Female

Total

360

360

720

369.05

351.95

61723.00

− 1.255

0.209

F4 Buying airline/railway

tickets by using credit card

at special counters saves

time.

Malehttp://www.ukassignment.org/liuxuezuoyedaixie/xinxilanzuoye/

Female

Total

360

360

720

359.87

361.13

64572.50

− 0.087

0.931

F5 Additional facilities with

credit card increase its

usage value.

Male

Female

Total

360

360

720

344.23

376.77

58943.00

− 2.261

0.024*

*Mean Rank difference is signifi cant at the 0.05 level

Table 6 Mann – Whitney U -test for differences among gender categories towards perception of supplementary

services in managing psychological risk with credit cards

S. No. Statements Gender

category

N Mean

rank*

U Z Signifi cance

P1 My family members are not

dependent on me to use credit

card due to add-on card

availability.

Male

Female

Total

360

360

720

367.31

353.69

62348.00

− 1.004

0.316

P2 Additional facilities like ATM

access, cash withdrawal, etc.

with a credit card provides

me a sense of security.

Male

Female

Total

360

360

720

397.47

323.53

51491.00

− 5.075#p#分页标题#e#

0.000*

P3 I prefer to have recognition and

attention, if purchases are made

through credit card.

Male

Female

Total

360

360

720

378.04

342.96

58486.50

− 2.359

0.018*

P4 I feel myself in safe hands due to

zero/limited lost card liability.

Male

Female

Total

360

360

720

382.99

338.01

56702.00 − 3.200 0.001*

P5 I feel good about my decision to

have additional facilities with my

credit card.

Male

Female

Total

360

360

720

352.91

368.09

62066.00 − 1.110 0.267

*Mean Rank difference is signifi cant at the 0.05 level

Goyal

342 Journal of Financial Services Marketing Vol. 12, 4 331–345 © 2008 Palgrave Macmillan Ltd 1363-0539 $30.00

positive perception towards the effective

role of supplementary services to control

psychological risk associated with credit

cards.

The perception of respondents, on the

basis of their gender, towards the role of

supplementary services for handling the

functional risk associated with credit cards is

analysed with the help of Table 5 with the

Mann – Whitney U-test. The results indicate

that females favour the functional viability of

supplementary services more than males in

general as per statement F5 (signifi cant at

p < 0.05) and also indicate more perceived

utility of ATM access, cash advance and cash

withdrawal facility than males as per

statements F1 and F2 (signifi cant at p < 0.05).

Both males and females have near equal

preference for facilities of add-on card and

airline / railway ticket purchase through credit

card.

Table 6 presents the role of gender in

determining the function of supplementary

services in controlling the psychological risk

with credit card purchase — with the Mann –

Whitney U-test. It can be inferred that males

perceive more psychological security with

additional features as per the signifi cance

( p < 0.05) of statements P2, P3 and P4.

Further, the results show that additional

facilities are perceived to provide more sense

of security, safety and of recognition to males

than females. Both genders, however, have

near equal perception about feeling good to

have additional benefi ts with their credit

cards as per statement P5.

CONCLUSION

It is examined whether the supplementary

services are helpful in controlling the

functional risk and psychological risk

perceived to be associated with credit cards.

Respondents perceive that supplementary

services provide and enhance the functional

viability and operational value of credit cards.

In other words, consumers show positive#p#分页标题#e#

perceptions regarding the ability of

supplementary services to meet their fi nancial

requirements and manage functional risk.

With respect to gender categories, females

place more functional value on

supplementary services than males. In case of

the age categories, however, a particular age

group does not perceive more functional

utility of all additional benefi ts over other

age groups. Different age categories have

preferences for different supplementary services

to fulfi l their functional needs from credit cards.

The results indicate, however, that younger

people associate more functional value to

supplementary services with credit cards.

There is a favourable perception of

supplementary services in controlling the

psychological risk too. Respondents feel

mental satisfaction to have supplementary

services with credit cards. Here, contrary to

the perception towards functional benefi ts

from supplementary services, in gender

categories males perceive more psychological

utility than females and in age categories

older people draw more psychological value

than younger people.

MANAGERIAL IMPLICATIONS

1. The study has revealed that presence of

supplementary services can manage

consumer perceptions towards functional

risk and psychological risk. It is reviewed

from past studies that, in the case of

services, due to lack of pre-purchase

search options, there is an increase in the

level of perceived risk. As a result,

marketers can provide suffi cient

information about various supplementary

services to potential consumers, which

may function as a reliable source of

information and can help them to make

reduced risk-based decisions. In other

words, more potential buyers may be

converted into actual buyers.

2. The age group 18 – 25 years shows a

positive response for the functional aspect

of supplementary services, although

Managing perceived risk for credit card purchase

© 2008 Palgrave Macmillan Ltd 1363-0539 $30.00 Vol. 12, 4 331–345 Journal of Financial Services Marketing 343

ranked low on psychological risk

perception. The present supplementary

service features, however, may not be of

direct relevance to this age group like

insurance for spouse and an add-on card

due to their lifestyle. Marketers, therefore,

can develop relevant supplementary

services for this age group and can tap

nontraditional users for growth.

3. One of the signifi cant applications can be

derived from the fact that supplementary

services are able to address the

psychological risk associated with credit

card purchase for the 55 + year age

group market. Thus, the 55 + year age

group can be satisfi ed for psychological#p#分页标题#e#

benefi ts of supplementary services with

credit card purchase. This can result in

increased usage of credit cards by this age

group. This can be a signifi cant

understanding for marketers due to the

fact that it is diffi cult to break the set

traditional ways of carrying out one ’ s

activities by this age group, especially

traditional ways of spending money and

doing banking.

4. An interesting fi nding is that males

perceive more psychological benefi t and

females perceive more functional benefi ts

with supplementary services for credit

cards. This can be a useful fi nding for

marketers to offer credit cards as well as

associated additional features. This can,

however, be seen with existing female

credit cards where more functional

benefi ts are provided in terms of making

purchases for ladies ’ items.

5. Marketers can target the segment of the

24 – 35-year age group by further

understanding their needs and requirements

and providing attractive added features with

the credit cards. This is the age group

where people start their career, look

forward to growth opportunities, increase

efforts to enhance living standards and also

expand families. Owing to the growing

needs, a credit card can provide the

required fi nancial support.

REFERENCES

1 Zeithaml , V . , Parasuraman , A . and Berry , L . L . ( 1985 )

‘ Problems and strategies in services marketing ’ , Journal of

Marketing , Vol. 49 , pp. 33 – 46 .

2 Wyckham , R . G . , Fitzroy , P . and Mandry , G . ( 1975 )

‘ Marketing of services: An evaluation of the theory ’ ,

European Journal of Marketing , Vol. 9 , pp. 59 – 67 .

3 Booms , B . H . and Bitner , M . J . ( 1981 ) ‘ Marketing

strategies and organization structure for service fi rms ’ ,

in Donnelly, J. H. and George, W. R. (eds) ‘ The

Marketing of Services ’ , American Marketing Association,

Chicago .

4 Donnelly , J . H . , Berry , L . L . and Thompson , T . W . ( 1985 )

‘ Marketing Financial Services ’ , Dow Jones- Irwin,

Homewood, IL .

5 Laroche , M . , Bergeron , J . and Goutaland , C . ( 2003 ) ‘ How

intangibility affects perceived risk: The moderating role of

knowledge and involvement ’ , Journal of Services Marketing ,

Vol. 17 , No. 2 , pp. 122 – 140 .

6 Cunningham , L . F . , Gerlach , J . and Harper , M . D . ( 2005 )

‘ Perceived risk and e-banking services: An analysis from

the perspective of the consumer ’ , Journal of Financial

Services Marketing , Vol. 10 , No. 2 , pp. 165 – 178 .

7 Locander , W . B . and Hermann , P . W . ( 1979 ) ‘ The effects of

self-confi dence and anxiety in information seeking in#p#分页标题#e#

consumer risk reduction ’ , Journal of Marketing Research , Vol.

16 (May) , pp. 268 – 274 .

8 Credit card usage up in India, The Economic Times , 20th

January, 2005. Available at http://economictimes.

indiatimes.com/articleshow/msid-996268,prtpage-1.cms .

9 Mastercard targets 40% growth, Financial Express , 24th

January, 2005. Available at http://www.fi nancialexpress.

com/fe_full_story.php?content_id=51195 .

10 Credit cards: Banking on trust, 13th June, 2002,

Available at http://www.indiainfoline.com/pefi /feat/cred.

html .

11 Schiffman , L . G . and Kanuk , L . L . ( 1997 ) ‘ Consumer

Behaviour ’ , Prentice-Hall of India, New Delhi .

12 Turley , L . W . and LeBlanc , R . P . ( 1993 ) ‘ An exploratory

investigation of consumer decision making in the

service sector ’ , Journal of Services Marketing , Vol. 7 , No. 4 ,

pp. 11 – 18 .

13 Dowling , G . R . and Staelin , R . ( 1994 ) ‘ A model of

perceived risk and infl uenced risk-handling activity ’ ,

Journal of Consumer Research , Vol. 21 , No. (1st June) ,

pp. 119 – 134 .

14 Smith , J . B . and Bristor , J . M . ( 1994 ) ‘ Uncertainty

orientation ’ , Psychology and Marketing , Vol. 11 , No. 6 ,

November, pp. 587 – 607 .

15 Eiglier , P . and Langeard , E . ( 1977 ) ‘ A new approach to

services marketing ’ , in Eiglier, P., Langeard, E., Lovelock,

C. H., Bateson, J. E. G. and Young, R. F. (eds) ‘ Marketing

Consumer Services: New Insights ’ , Marketing Science

Institute, Cambridge , pp. 33 – 58 .

16 Zeithaml , V . ( 1981 ) ‘ How consumer evaluation processes

differ between goods and services ’ , in Lovelock, C. H.

(ed) ‘ Services Marketing ’ , Prentice-Hall, USA .

17 Guseman , D . S . ( 1981 ) ‘ Risk perception and risk

reduction in consumer services ’ , in Donnelly, J. H. and

George, W. R. (eds) ‘ The Marketing of Services ’ ,

American Marketing Association, Chicago .

Goyal

344 Journal of Financial Services Marketing Vol. 12, 4 331–345 © 2008 Palgrave Macmillan Ltd 1363-0539 $30.00

18 Murray , K . B . ( 1991 ) ‘ A test of services marketing theory:

Consumer information acquisition activities ’ , Journal of

Marketing , Vol. 55 (January) , pp. 10 – 25 .

19 Murray , K . B . and Schlacter , J . L . ( 1990 ) ‘ The impact of

services versus goods on consumers ’ assessment of

perceived risk and variability ’ , Journal of the Academy of

Marketing Science , Vol. 18 , No. 1 , pp. 51 – 65 .

20 Spence , H . E . , Engel , J . F . and Blackwell , R . D . ( 1970 )#p#分页标题#e#

‘ Perceived risk in mail-orders and retail store buying ’ ,

Journal of Marketing Research , Vol. 7 (August) , pp. 364 – 369 .

21 Hanson , F . ( 1972 ) ‘ Consumer Choice Behaviour ’ , The

Free Press, New York .

22 Roselius , T . ( 1971 ) ‘ Consumer rankings of risk reduction

methods ’ , Journal of Marketing , Vol. 35 (January) , pp. 56 – 61 .

23 Hawkins , D . I . , Best , R . J . and Coney , K . A . ( 1995 )

‘ Consumer Behaviour: Building Marketing Strategy ’ ,

McGraw-Hill, USA .

24 Lutz , R . J . and Reilly , P . T . ( 1973 ) ‘ An exploration of the

effects of perceived social and performance risk on

consumer information acquisition ’ , in Ward, S. and

Wright, P. (eds) ‘ Advances in Consumer Research ’ ,

Vol. 2, Association for Consumer Research, Urbana, IL ,

pp. 393 – 405 .

25 Perry , M . and Hamm , B . C . ( 1969 ) ‘ Canonical analysis of

the relationship between socioeconomic risk and personal

infl uence in purchase decisions ’ , Journal of Marketing

Research , Vol. 6 (August) , pp. 351 – 354 .

26 Robertson , T . S . ( 1971 ) ‘ Innovative Behaviour and

Communications ’ , Holt, Reinhardt, and Winston, New York .

27 Freiden , J . B . and Goldsmith , R . E . ( 1989 ) ‘ Prepurchase

information-seeking for professional services ’ , Journal of

Services Marketing , Vol. 3 , No. 1 , pp. 45 – 55 .

28 Gronroos , C . ( 1978 ) ‘ A service-oriented approach to

marketing of services ’ ,http://www.ukassignment.org/liuxuezuoyedaixie/xinxilanzuoye/ European Journal of Marketing , Vol.

12 , No. 8 , pp. 588 – 601 .

29 Norman , R . ( 1984 ) ‘ Service Management: Strategy and

Leadership in Service Businesses ’ , Wiley, Chichester .

30 Lovelock , C . H . ( 1991 ) ‘ Services Marketing ’ ,

Prentice-Hall, USA .

31 Goncalves , K . P . ( 1998 ) ‘ Services Marketing: A Strategic

Approach ’ , Prentice-Hall, New Jersey .

32 Berry , L . ( 1983 ) ‘ Relationship marketing ’ , in Berry, L.,

Shostack, G. L. and Upah, G. D. (eds) ‘ Emerging

Perspectives on Services Marketing ’ , American Marketing

Association, Chicago .

33 Levitt , T . ( 1983 ) ‘ The Marketing Imagination ’ , Free Press,

New York .

34 Gronroos , C . ( 1990 ) ‘ Services Marketing and

Management ’ , Lexington Books, Massachusetts .

35 Goyal , A . ( 2004 ) ‘ Role of supplementary services in the

purchase of credit card services in India ’ , Asia Pacifi c

Journal of Marketing and Logistics , Vol. 16 , No. 4 , pp. 36 – 51 .

36 Delener , N . and Katzenstein , H . ( 1994 ) ‘ Credit card

possession and other payment systems: Use patterns#p#分页标题#e#

among Asian and Hispanic consumers ’ , The International

Journal of Bank Marketing , Vol. 12 , No. 4 , pp. 13 – 24 .

37 Duffy , H . ( 1990 ) ‘ Marketing for survival: Credit card

strategies for the 1990s ’ , Bank Management , Vol. 66 , No. 4

(April) , pp. 44 – 47 .

38 Warwick , J . and Mansfi eld , P . ( 2000 ) ‘ Credit card

consumers: College students ’ knowledge and attitude ’ ,

Journal of Consumer Marketing , Vol. 17 , No. 7 , pp. 617 – 628 .

39 Kara , A . , Kaynak , E . and Kucukemiroglu , O . ( 1994 )

‘ Credit card development strategies for the youth market:

The use of conjoint analysis ’ , The International Journal of

Bank Marketing , Vol. 12 , No. 6 , pp. 30 – 36 .

40 Mathur , A . and Moschis , G . P . ( 1994 ) ‘ Use of credit cards

by older Americans ’ , Journal of Services Marketing , Vol. 8 ,

No. 1 , pp. 27 – 36 .

41 Chan , R . ( 1997 ) ‘ Demographic and attitudinal differences

between active and inactive credit cardholders: The case

of Hong Kong ’ , The International Journal of Bank

Marketing , Vol. 15 , No. 4 , pp. 117 – 125 .

42 Meidan , A . and Dimitris , D . ( 1994 ) ‘ Credit and charge

card selection criteria in Greece ’ , The International Journal

of Bank Marketing , Vol. 12 , No. 2 , pp. 36 – 44 .

43 Murray , C . ( 1996 ) ‘ Putting the power into plastic ’ ,

Chartered Banker , Vol. 2 , No. 6 (June) , pp. 17 – 19 .

44 Worthington , S . and Horne , S . ( 1992 ) ‘ Affi nity credit card

in the United Kingdom: Card issuer strategies and affi nity

group aspirations ’ , The International Journal of Bank

Marketing , Vol. 10 , No. 7 , pp. 3 – 10 .

45 Worthington , S . ( 2001 ) ‘ Affi nity credit cards: A critical

review ’ , International Journal of Retail and Distribution

Management , Vol. 29 , No. 11 , pp. 485 – 508 .

46 Worthington , S . ( 1986 ) ‘ Retailer credit cards and direct

marketing — A question of synergy ’ , Journal of Marketing

Management , Vol. 2 , No. 2 , pp. 125 – 311 .

47 Dowling , G . R . ( 1986 ) ‘ Perceived risks: The concept and

its measurement ’ , Psychology and Marketing , Vol. 3 , No. 3 ,

pp. 193 – 210 .

48 Dowling , G . R . and Staelin , R . ( 1994 ) ‘ A model of

perceived risk and intended risk-handling activity ’ , Journal

of Consumer Research , Vol. 21 (June) , pp. 119 – 134 .

49 Mitchell , V . ( 1999 ) ‘ Consumer perceived risk:

Conceptualizations and models ’ , European Journal of

Marketing , Vol. 33 , No. 1/2 , pp. 163 – 195 .

APPENDIX A

Set of Statements Used for Developing

Required Constructs for the Study#p#分页标题#e#

I Statements for measuring association

between supplementary services and

functional risk

1. Separate charges for some extra facilities

are worth their value like petrol and

railway ticket purchases.

2. Additional benefi ts help in meeting all

my fi nancial needs.

3. Additional benefi ts are appropriately

designed to meet fi nancial requirements.

4. Additional facilities with a credit card

meet my expectations.

5. I would prefer to have added benefi ts

with my credit card.

Managing perceived risk for credit card purchase

© 2008 Palgrave Macmillan Ltd 1363-0539 $30.00 Vol. 12, 4 331–345 Journal of Financial Services Marketing 345

6. * Additional facilities with a credit card

increase its usage value.

7. * Buying airline / railway tickets by using a

credit card at special counters save time.

8. * Through an add-on card other family

members can also use the credit card.

9. * I do not face the problem of inadequate

cash because of ATM access, cash

advance and cash withdrawal facilities

with my credit card.

10. * ATM access, cash advance and cash

withdrawal and other facilities help to

meet my fi nancial requirements

effectively.

* These statements were judged to be of

high value by the experts and considered as

major components of the construct towards

association of functional risk and

supplementary services.

II Statements for measuring association

between supplementary services and

psychological risk

1. Protection against loss or damage from

fi re for items purchased through credit

card provides me with a sense of security.

2. People give recognition and attention,

if purchases are made through credit

card.

3. I feel proud while making purchases

through credit cards.

4. It is easy to make a purchase decision on

the basis of additional benefi ts.

5. I feel delighted to have extra benefi ts

with my credit card.

6. * * I feel good about my decision to have

additional facilities with my credit card.

7. * * I feel myself in safe hands due to

zero / limited lost card liability.

8. * * I prefer to have recognition and

attention, if purchases are made through

credit card.

9. * * Additional facilities like ATM access,

cash withdrawal, etc with credit card

provides me with a sense of security.

10. * * My family members are not dependent

on me to use credit card due to add-on

card availability.

* * These statements were judged to be of

high value by the experts and considered as

major components of the construct towards

association of psychological risk and

supplementary services.

|