|

论文题目:定量分析Assignment

论文语种:英文

您的研究方向:工商管理

是否有数据处理要求:否

您的国家:中国

您的学校背景:国际交流学院

要求字数:计算过程

论文用途:本科课程论文 BA Assignment

是否需要盲审(博士或硕士生有这个需要):

补充要求和说明:要求一次性通过,并拿到C这个等级,等级划分为P、C、D、HD(从低到高),如果这次合作成功,我将打算长期与你们合作,并介绍大量的同学光顾。先定价,然后再具体分析题目,我们老师有相关的提示,做起来方便许多。

STUDENT NAME:

STUDENT ID NUMBER:

MAT10248 – Quantitative Analysis for Business

MATHEMATICS PROJECT

Please use this cover sheet when submitting your project

Complete the following summary table

Value: 20%

PLEASE ENSURE YOU KEEP A COPY OF YOUR PROJECT

MAT10248 – Quantitative Analysis for Business

Mathematics Project

(Marked out of 40 but worth 20% of final assessment)

This project requires you to explore the profitability, or otherwise, of buying an investment property. This may be for yourself, friend or family member, or a client.

This project covers some of the content of Topics 2, 4, 5 and 6 and Objectives 1, 3, 5, 11 and 12 of the unit.

You are required to use Excel when completing the project.

Your findings and conclusions should be presented as a report, letter or business memo (referred to as the report). Your calculations should be attached as an appendix to the report. If you do not have access to or can not use an equation editor this appendix may be hand written.

The project should be 3 to 5 pages (maximum of 800 words) in length, plus the appendices with your calculations.

Please submit a hard-copy of a word-processed document into which of your Excel outputs, tables and graphs, have been copied.

Please use the attached cover sheet when you submit your Project

School of Commerce and Management MAT10248 Projects 2009

Project Situation

This project leads you through an investigation of the profitability or otherwise of buying an investment property.

You are required to communicate the results of your investigations in a brief report explaining your results and recommendations.#p#分页标题#e#

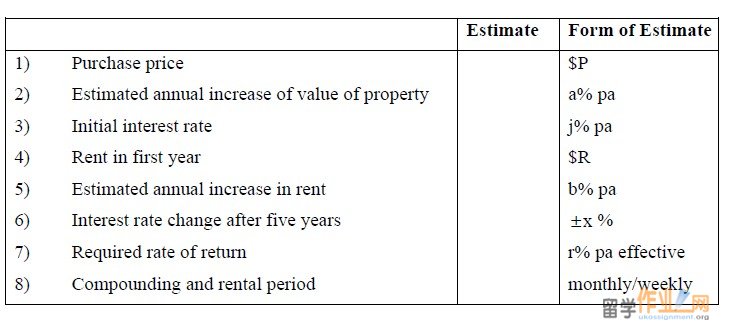

Estimates

Make the following estimates (you may research these, however, you may choose any that seem realistic) and enter them on the cover sheet for the project.

1) Purchase price of the property, $P.

2) Estimated annual increase of value of the property for next ten years, a% annually (must be non-zero).

3) Nominal interest rate on the loan, j% pa compounded monthly/weekly.

4) Rent received during the first year of ownership, $R monthly/weekly.

5) Estimated annual increase in rent (must be non-zero).

6) Projected interest rate change after five years x%± (must be non-zero).

7) Required/minimum rate of return on investment, r% pa effective (must be non-zero).

8) Compounding and rental period - use the same period; monthly or weekly, for Estimates (3) and (4).

Assumptions

Make the following assumptions.

a) You obtain a loan for 80% of purchase price for 25 years as you have cash for the 20% deposit and other purchase expenses.

b) Rental expenses, excluding loan repayments, (that is, insurance, real estate commission, maintenance etc) are 20% of rental income.

c) Purchase expenses are 10% of purchase price.

d) Selling expenses are 12% of selling price.

e) The interest rate is fixed for five years, after which it is estimated to change by Estimate 6, and then fixed for a further five years.

For simplicity, ignore any tax considerations.

School of Commerce and Management MAT10248 Projects 2009

Calculations (30 marks)

The following calculations should appear as an appendix to your report. This may be hand written. You may use formulas, Excel, or financial calculator.

Part A Loan Repayment (11 marks)

• Calculate the required loan repayment for the first five years of the loan. Use Assumption (a), and Estimates (1), (3) and (8).

• Use Excel to construct an amortisation schedule to calculate the amount owing after five years of payments.

• Assume that after five years the interest rate changes by x%±, calculate the required loan repayment for the next five years of the loan. Use Estimate (6).

• Use Excel to continue the amortisation schedule to calculate the amount owing after ten years of payments.

Part B Estimated Revenue and Cost (9 marks)

• Use your estimated rent in year 1 and estimated annual increase, Estimates (4) and (5) to construct a revenue function for the annual revenue generated by the investment. Present this as an equation of the form R(n)=… giving annual revenue in nth year of investment.

• Use the loan repayments calculated in Part A and Assumption (b) to construct a cost function for the annual cost of the investment. Present this as an equation of the form C( giving annual cost in nth year of investment. n)=…

Hint: construct two cost functions one for first five years of the investment and one for the second five years.#p#分页标题#e#

Note: Treat both the interest and the principal components of the loan repayments as a cost that is

Annual Cost Annual Rental Expenses Annual Loan Repayments=+

• Graph the revenue and cost functions on the same graph to decide if the investment makes an annual profit in the first ten years of owning the property. If the investment does not make an annual profit in the first ten years extend the graph to 25 years, (assume no change in interest rates after ten years).

• Estimate from the graph when annual revenue will first exceed annual cost, that is, make an annual profit.

School of Commerce and Management MAT10248 Projects 2009

Now assume that property is sold after ten years.

Part C Sale Value of Property (2 marks)

• Calculate the estimated sale value of the property in ten years. Use Estimates (1) and (2).

Part D Estimated Cash Flows (5 marks)

• Use the cost and revenue functions in Part B to estimate the annual cash flows, for each of the ten years of the investment.

Also need to include:

• Purchase expenses (Assumption (c)) and the deposit (Assumption (a)) are cash outflows/costs in Year 0.

• In Year 10 estimated selling price (Part C) is a cash inflow/revenue while selling expenses (Assumption (d)) and amount owing on loan (Part A) are cash outflows/costs.

Part E Net Present Value (3 marks)

• Use the estimated cash flows from part D and your required rate of return, Estimate (7) to calculate the net present value of this investment.

Note: You may find in your finance units that similar examples do not include the interest and/or principal component of the loan repayment as a cash outflow/cost in net present value calculations.

School of Commerce and Management MAT10248 Projects 2009

Report (10 marks)

Communicate the results of your calculations as a brief report, memo, or letter. This should be a maximum of 3 pages and 800 words.

Choose an appropriate form of communication for your scenario.

For example,

a report to a client

a memo or letter to a friend or family member

If you are planning on buying the investment property for yourself this may be a letter or memo to a partner/spouse explaining why you should or should not invest in the property. It could also be part of a report or letter to a finance provider requesting the required financial support.

Then use an appropriate style, without unnecessary mathematical jargon and equations, to communicate your results and recommendations clearly.

Include your Excel graphs in your report and you may wish to include tables or schedules to illustrate your results and conclusions.

Make sure you:

• Introduce the investment property, estimates, and assumptions.

• Present the results of your calculations in an understandable and non-mathematical way, however, include your annual revenue and cost functions.

• Comment on your results, in particular#p#分页标题#e#

• Is the investment profitable both annually during the investment and overall if property is sold in ten years.

• How may profit change if the interest rate change after five years is more than or in a different direction than that estimated?

• How may profit change if the growth in property value is more or less than that estimated?

• Include your recommendations.

School of Commerce and Management MAT10248 Projects 2009

Marking Criteria

See the marking and feedback sheet for actual allocation of marks.

Cover Sheet

If the cover sheet is not completed correctly with the estimates you use for the project a maximum of two marks may be deducted, as this causes the marker extra work and frustration.

Calculations

• To appear in the appendix.

• Full marks will be given for a correct answer, however, obtained. You may use Excel, formulae or financial calculator.

• Marks will be deducted for significant rounding error and incorrect calculation.

• If an incorrect value is used in a subsequent calculation, marks will be given if the subsequent calculation is correct. However, if the marker cannot follow your working you may lose marks.

• If using a financial calculator give your inputs for example PV = ?, n = ? etc as well as your solution for example, FV = ?

• If using Excel, set out your worksheet as in Reading 2 with a data area and a calculation area.

Amortisation Schedule

• A reduced schedule (with unnecessary rows hidden) to appear in the appendix .

• Required to use Excel for full marks.

Excel Graphs

• To appear in the report and appendix.

• To obtain full marks graphs must be correct, including correct labels on both axes and a title.

• Marks will be deducted if;

o graphs incorrect

o Excel not used

o axes incorrectly or not labelled

o no title

o scale on axes distorts graphs.

School of Commerce and Management MAT10248 Projects 2009

Report

• Maximum 800 words and 3 pages marks will be deducted if this is greatly exceeded.

• To obtain full marks report must

o be well structured and analysed

o clearly communicate the results of your calculations in language appropriate for your audience

o include your conclusions and recommendations

o include appropriate schedules, graphs and/or tables to summarise your results.

• Marks will be deducted if

o there is little or no comment on or interpretation of the results

o recommendations not made and/or justified

o unnecessary mathematical jargon and equations appear

o report is confusing and/or not readable

o report is handwritten.

• Marks will not be deducted for minor spelling and grammatical errors. However, marks will be deducted for spelling and grammatical errors that affect the readability of the report.#p#分页标题#e#

• As there is no specified format for the report, no marks will be given or deducted for format.

Notes

• You should not need to read beyond the study guide and textbooks to complete the project.

• Use Excel or your financial calculator, for as much of the mathematical calculation as possible. You do not need to repeat any Excel calculations by hand.

• You probably will not need to reference, but if you do use any consistent referencing style.

School of Commerce and Management MAT10248 Projects 2009

|