|

肥料

肥料,对于农业生产部门是至关重要的,是印度经济的支柱。化肥可以分为化学肥料和有机肥料,在印度,化学肥料的使用更加突出。这些肥料的使用在印度农业生产中都扮演了非常重要的角色,起到了极大的作用,直接影响印度农业的丰收与否,不仅满足粮食的需求总量,而且还创建一个出口顺差。

印度化学肥料的使用直接关乎印度绿色革命的成功,对印度绿色革命的成功起到了至关重要的作用,随之影响和改变了自力更生的食品生产链,进而推动了这个行业的发展。目前印度是世界上第三大化肥生产商。化肥行业也是印度最重要的能源密集型行业,除了铝、水泥、钢铁、玻璃和纸产业之外,化肥产业已然成为印度的支柱产业,因为它需要各种燃料如天然气、燃油和石脑油作为原料进行生产。 Fertiliser

Fertiliser, a crucial input to the agricultural sector, forms the backbone of the Indian economy. Fertilisers can be classified into chemical fertilisers and organic fertilizers, of which chemical fertilisers are more prominently used in India. These have played a significant role in India’s agricultural success story, by not only fulfilling the total food grains requirements, but also creating an exportable surplus.

Chemical fertilisers played a crucial role in the success of India's green revolution and consequent self-reliance in food-grain production, which in turn gave an impetus to the growth of this sector. Presently India is the third largest producer of fertiliser in the world. The fertiliser industry is also one of the most energy intensive sectors within the Indian economy apart from aluminum, cement, iron & steel, glass and paper, as it requires various fuels like natural gas, fuel oil and naphtha, as raw materials for production. Industry Size and structure The Indian Fertiliser Industry, under the purview of the Ministry of Chemicals & Fertilisers can be segmented on the basis of the various nutrients. Union Ministry of Chemicals and Fertilisers (Department of Fertilisers) Structure of the Indian Fertiliser Industry Potash (K) (Mainly imported) Phosphate (P) Public Private Co-operatives Nitrogen (N) Public Private

Co-operatives

According to the data released by the Department of Fertilisers, the total installed capacity of the Nitrogen segment in India stands at 12.06 mn MT (million metric tonnes), of which, the public sector accounts for 29%, while private and co-operative sectors account for 26.27% and 44.73%, respectively.

The capacity in the phosphate segment is 5.7 mn MT with the share of public sector being 7.65%, while that of private sector is 30.27% and co-operatives accounts for 62.08%. There being no viable resources or reserves of potash in the country, the entire requirement is entirely imported. In addition to these segments, there are the complex fertilisers produced by combining various nutrients such as nitrogen, phosphate and potash in different proportions.

While urea, ammonium sulphate, calcium ammonium nitrate (CAN) and ammonium chloride are the nitrogenous fertilisers produced in the country; the only phosphatic fertiliser being produced is SSP (single superphosphate). Production of complex fertilisers include DAP (Diammonium Phosphate), several grades of nitrophosphates and NPK complexes. Of these, urea and DAP are the main fertilisers produced indigenously. Demand & Supply – side factors

Fertiliser consumption mainly depends on various agriculture related factors such as soil quality, farming methods, rainfall and irrigation patterns, different geographical aspects, calamities, availability of technology and information, varieties and qualities of seeds as well as access to capital and credit and other inputs. With a shift in agricultural production from the traditional system of farming to intensive cultivation, fertiliser demand got a boost.

Moreover, macro-oriented factors such as crop related market forces, cropping pattern and fertiliser pricing policies too influence fertiliser consumption. Further, the Government has also taken various steps to spread the awareness about the benefits of fertilisers and ensure efficient usage of fertilisers, through the promotion of soil testing laboratories throughout the country.

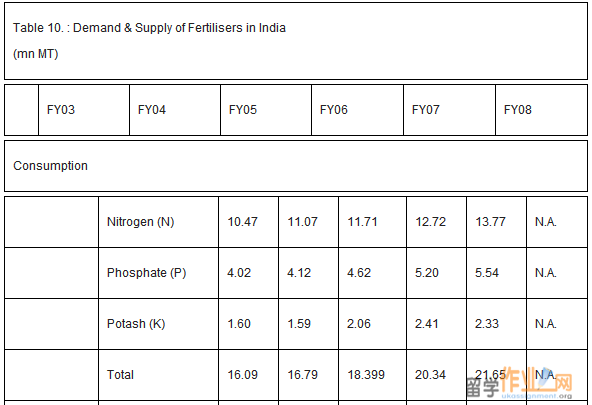

Consequently, the annual consumption of fertilisers in nutrient terms (N, P & K) increased from 0.07 mn MT in 1951-52 to 21.6 mn MT in 2006-07, with the per hectare consumption, which was less than 1 kg in 1951-52 increasing to 13.26 kg (estimated) in 2006-07. Urea and DAP are the most popular fertilisers, accounting for a major portion of the total fertiliser consumed in the country. Consumption of Urea, DAP and MOP (Muriate of potash) has been increasing continuously during the last few years, and in 2006-07 the consumption level stood at 24.48 mn MT, 6.92 mn MT and 2.40 mn MT, respectively.

Further, as per the projections of the Department of Agriculture & Cooperation (DAC), the demand during the Kharif season in FY072007 was for 13.16 mn MT of urea, 4.0 mn MT of DAP and 1.65 mn MT of MOP. This demand was met fully and sales of 12.45 mn MT of Urea, 3.61 mn MT of DAP and 1.41 mn MT of MOP were registered. Similarly, duirng the Rabi season of FY08, the demand was for 14.0 mn MT of Urea, 4.91 mn MT of DAP and 1.96 mn MT of MOP.

On the supply front, as per statistics provided by the Department of Fertilisers, at present there are around 64 large size fertiliser units in the country, manufacturing a wide range of nitrogenous and phosphatic/complex fertilisers. Of these, 39 units produce urea, 18 units produce DAP and complex fertilisers, 7 units produce low analysis straight nitrogenous fertilisers. Further, from these, 9 units produce ammonium sulphate as a by-product.

Besides, there are about 79 small and medium scale units producing single superphosphate (SSP). With an installed capacity of 12.06 mn MT of nitrogen and 5.65 mn MT of Phosphate the domestic fertiliser industry has more or less attained the levels of capacity utilisation comparable internationally. The capacity utilisation during 2006-07 was 96.0% for nitrogen and 79.8% for phosphate. The estimated capacity utilisation for 2007-08 was 92.2% of nitrogen and 71.9% of phosphate. Within this, the capacity utilisation in terms of the urea plants was 103.1% in 2006-07 and was estimated to be 101.1% in 2007-08.

Moreover, domestic raw materials are available only for nitrogenous fertilisers. For the production of urea and other ammonia based fertilisers, methane constitutes major input and is obtained from natural gas/associated gas, naphtha, fuel oil, low sulfur heavy stock (LSHS) and coal. In the recent years, production has increasingly switched over to the use of natural gas, associated gas and naphtha as feedstock or raw materials as these are more efficient and less polluting than other heavy fuels like fuel oil and coal.

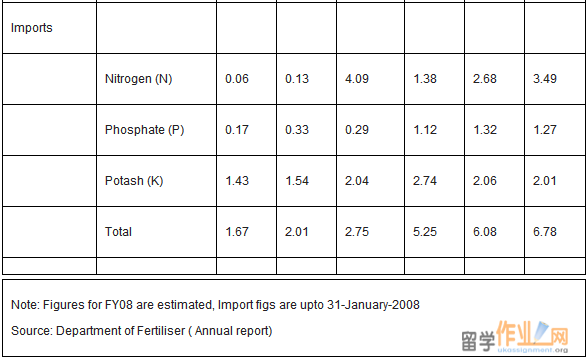

Of these, gas is in fair abundance within the country. The raw materials for the production of phosphatic fertiliser have to be imported as India has no source of elemental sulfur, phosphoric acid and rock phosphate. As for Potash (K), since there are no viable sources/reserves in the country, its entire requirement is met through imports.

Exports as well as dispatch of urea is prohibited without Government’s permission under the Fertilisers Movement Control Order (1973). Hence, the dispatches of urea to State and Union Territories (UT) from manufacturers are arranged through a monthly dispatch plan by the Department of Fertilisers under the Ministry of Chemical and Fertilisers.

The Government in consultation with the State Governments/UT assesses the requirement of urea for each state and UT prior to each crop season. Initially the demand is fulfilled through allocations from indigenous production. However, in case of a gap between the demand and the indigenous supply the demand is met through imported urea.

The production fertilisers stood at 11.57 mn MT for nitrogenous fertilisers and 4.51 mn MT for phosphatic fertilisers in FY07. This witnessed a to 11.12 mn MT for nitrogenous fertilisers and 4.06 mn MT for phosphatic fertilisers in FY08. Rising price of crude oil, whose derivatives are used as a key input in fertilizer plants as well as that of other raw materials, coupled with capacity limitations and delay in payment of subsidies by the Government led to the shortfall in fertilizer production in 2007-08. Table 10. :

Government Policies and Way forward:

Considering the vital role of fertilisers in making India self-reliant in terms of food security, the Government of India has been consistently pursuing policies conducive to increase the availability and usage of fertilisers in the country. In effect, the sector does feature Government control especially in terms of pricing and supply.

More importantly, the cost of fertilisers to farmers is subsidised, wherein the Government fixes a selling price and then compensates manufacturers for the difference between the cost of production and the selling prices. It is therefore interesting to briefly scan the some of the important Government policies concerning this sector and the implications and impact.#p#分页标题#e#

In 1973, when the oil price shock led to an overshooting of the prices of imported naptha and oil, the Government introduced the Retention Price Scheme (RPS) in 1977 for indigenous nitrogenous fertiliser units, to provide the farmers fertilisers at affordable rates without harming the interests of the manufacturers.

Under RPS, the difference between retention price (cost of production as assessed by the Government plus 12% post tax return on net worth) and the statutorily notified sale price was paid as subsidy to each urea unit. The policy provided a cushion to ensure reasonable return on investment and facilitated healthy development of the fertiliser industry. The Scheme was later extended to phosphatic and other complex fertilisers in February 1979 and Single Super Phosphate (SSP) in 1982.

The National Industrial Policy of 1991 delicensed the fertiliser industry, and facilitated the setting up of many new manufacturing units. Meanwhile, the devaluation of the rupee in 1991 enhanced the burden of subsidy was began adding pressure to the Government budget. This prompted the Government to progressive decontrol of price and distribution of P & K fertilisers and also decanalise imports. As a result Retention Pricing Scheme got confined to urea. Consequently, the prices of these fertilisers increased sharply leading to fall in their demand. To arrest decline in their consumption, Department of Agriculture & Cooperation (DAC) introduced a scheme of concession on decontrolled P & K fertilisers in 1992-93 on an adhoc basis.

Presently (DAP, 18-46-0), Mono-Ammonium Phosphate (MAP, 11-52-0), Muriate of Potash (MOP, 0-0-60), 11 grades of Complex Fertilisers and Single Super Phosphate (SSP, 0-16-0) are covered under the Concession Scheme for decontrolled P&K fertilisers. The, Government fixes the Maximum Retail Price (MRP) of DAP, MAP, MOP and NPK Complexes uniformly across the country. The difference between the total delivered costs of the fertiliser at the farm gate and the MRP payable by the farmers is given by the Government of India as Concession / Subsidy to the farmers and paid to the fertiliser manufactures and importers. With effect from 1st April 1997, concession to these fertilisers was increased vis-à-vis their indicative MRPs to give impetus to their demand.

The MRP of P & K fertilisers indicated by the Government of India has remained unchanged from 2002-03 till date. On the other hand, due to continuous increase in price of inputs and raw materials, total delivered cost of fertilisers covered under the Concession Scheme has increased.

This has called for increased compensation for the manufacturers or importers. As a result, the Department of Fertilisers entrusted the Tariff Commission the responsibility to conduct a fresh cost price study of the P & K fertilisers and update various parameters under the Concession Scheme. The recommendations of the Tariff Commission are expected soon. However, the Government has decided to continue with the Concession Scheme on decontrolled P & K fertilisers during 2007-08.

In the interim years, as per the recommendations of the Expenditure Reforms Commission (ERC) a New Pricing Scheme (NPS) for urea units for replacing the RPS was formulated and notified on January 1, 2003. Under the Scheme it was envisaged that decontrol of urea distribution/movement will be carried out in a phased manner. The process of deconcontrol is being undertaken in different stages and the stage-111 of NPS is under place effective from October 1, 2006 to March 31, 2010.

The pricing policy for urea units for Stage-III the NPS was formulated in January 1, 2004 keeping in view the recommendations of the Working Group which was set up for reviewing the effectiveness of Stage-I and II of NPS under the Chairmanship of Dr. Y.K. Alagh. The Policy aims at promoting further investment in the urea sector, encouraging increase in indigenous production from the existing urea units in the country and facilitating early conversion of non-gas based Units to gas, leading to substantial savings in subsidy. Natural gas based plants currently account for more than 66% of urea capacity, while naphtha is used for less than 30% urea production and the balance capacity is based on fuel oil and LSHS as feedstock.

The policy also incentivised additional urea production and encouraged investment in Joint Venture projects abroad. It also aimed at establishing a more transparent and efficient urea distribution and movement. It is expected that with the launch of the Fertiliser Monitoring System (FMS) to monitor movement of fertilisers upto district level and the freight rationalisation proposed in the new policy the distribution of fertilisers in remote corners of the country will improve considerably without any complaints of shortages, in future.

On the basis of the available and projected hydrocarbon (natural gas) resources in the country, it is observed that Nitrogen (Urea) is the only fertiliser where the country can attain self-sufficiency and also be a net exporter. However, with the demand- production gap rising every year (demand may reach upto 19 million tonnes by 2011-12), import dependence in this sector has increased over the years. In order to reduce this gap, there is a need to increase investments in urea sector, as there has been no significant investment in last 10 years, in this sector.

In line with the above requirement, the Cabinet Committee on Economic Affairs (CCEA) approved a policy for New Investments in Urea sector on August 2008. This policy is based on the recommendations of the Abhijit Sen Committee Sen Committee and aims at attracting investments in urea sector and generate additional production capacities through revamp and expansion of existing units and revival of the eight closed units of Fertiliser Corporation of India Ltd.

The New Investment Policy marks a departure from the existing policies which are based on cost plus approach with a 12% post tax return to the manufacturers. As the Policy provides for an Import Parity Price (IPP) benchmark with floor and ceiling price of US$ 250 PMT and US$ 425 PMT respectively, for pricing of urea from new investments in this sector. This could be considered as a paradigm shift made by the government by moving away from a cost plus based pricing approach to more of a market based one for the first time as the government has now linked the prices of urea fertilisers to the international market. This is likely to make urea available at competitive prices.

One of the major issues confronting the fertiliser sector is the subsidies which have been accelerating over the last few years. The major reason for this can be attributed to the sharp increase in the cost of input for indigenous fertilisers as well as rising prices of imported fertilisers. Moreover, the cost of various inputs such as coal, gas, naphtha, rock phosphate, sulphur, ammonia, phosphoric acid, electricity, etc has gone up sharply in the recent years.

There is therefore a need to encourage R&D activities in the areas of new energy saving products, alternative feedstock, etc. As high energy costs restrict capacity expansion in urea sector, more and more joint ventures have to be encouraged. For the phosphate/potash, which lack potential reserves within the country, joint ventures are already being undertaken by various companies within India and abroad. Efforts are also being undertaken to make India – which currently imports urea –“a urea manufacturing hub”. A number of proposals for setting up new plants and expansion of existing plants have been received by the Department of Fertilisers. All of these plants are likely to use gas for producing urea. The fertiliser industry in India has helped India achieve self-sufficiency in food grains and has helped in rapid agricultural growth. The demand for fertiliser is growing at a fast pace and is expected to grow up to 28.08 mn MT by 20011-12. However, production has somewhat stagnated over the past few years, creating a demand-supply gap in the industry and provides ample opportunities for manufacturers to ramp up their capacities and for new entrants to set up production units. |

|

|||

| 网站地图 |