|

英国留学生金融学专业COURSEWORK 定制2009 MSc Finance and Banking This coursework is worth 20 per cent of the final course mark. It must be deposited in the “Essay Coursework for Marking” box beside Room The goal of this assignment is for you to demonstrate the use of econometric tools and analysis in examining a company that is traded on the New York Stock Exchange. Style Guideline All graphs, charts, regression outputs, etc. should be numbered and placed in the appendix. Your answers should refer to the appropriate item. Please, no plastic covers or binders. Order of Presentation

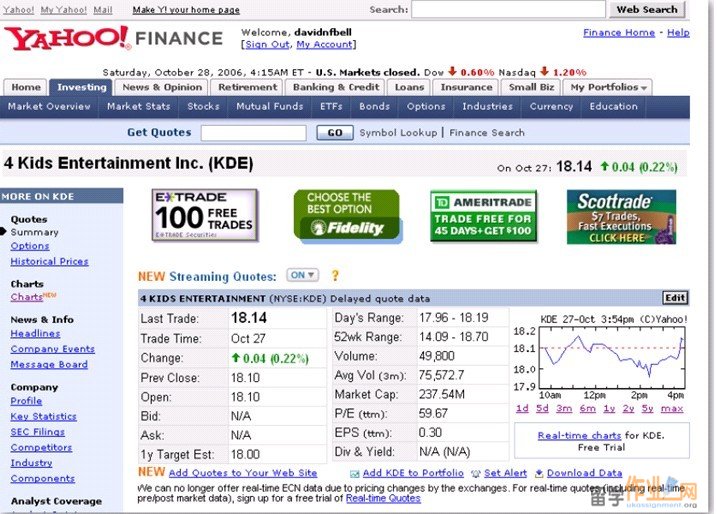

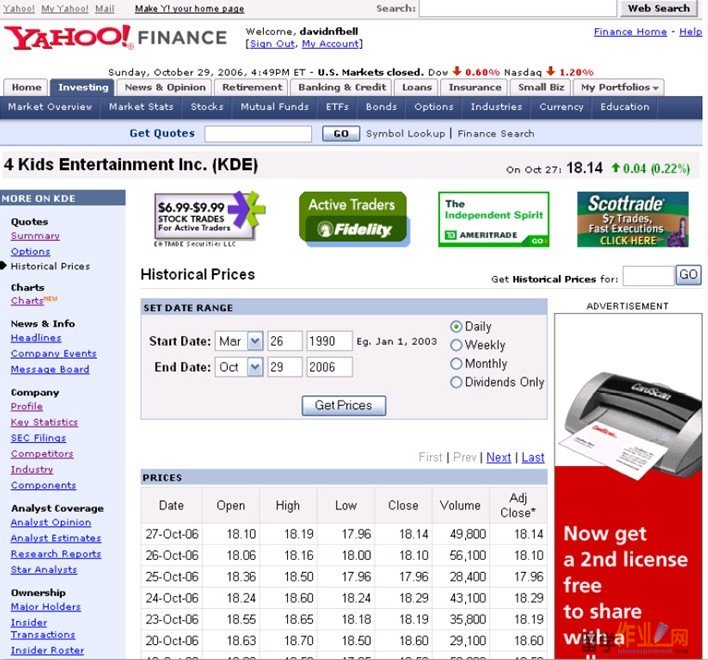

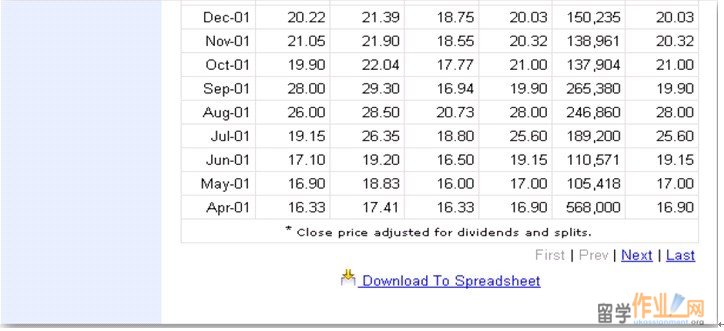

To find out what this means, consult the University rules on plagiarism. Evaluating Beta This coursework is about evaluating Beta coefficients for US companies belonging to the S&P 500 index. To carry out the coursework, you first have to carry out the following steps: 2.) Click once on the company code. This will connect you to the Yahoo Financial website for your company. You will get a screen that looks like: 3.) Select historical prices on the left sidebar and a screen like this will appear:  With this spreadsheet, you are now in a position to carry out the analysis.#p#分页标题#e# Definition The Beta of security i’s return is determined by: βi = Cov(Ri,Rm)/Var(Rm) where Rm is the return on the market (often replaced with the value-weighted market return or return on the S&P500 index).  Estimation Estimating the beta coefficient with historical data can be done using a linear regression: Ri = ai + biRm + ei. (3) bi is an estimate of βi. The time period for Beta is 3 years (36 months) when available. (We shall use weekly rather than monthly data) 英国留学生金融学专业COURSEWORK 定制Your four tasks are:  1) Describe your company and its main financial indicators. Do you believe this company is a good investment? Explain. (No more than one page) 2) Estimate a value for βi over the period November 2005 to October 2008. Explain how you would interpret the value of βi (No more than one page). 3) Test whether there was a significant change in the value of βi after Jan 2008. Interpret your finding (No more than one page) 4) Using the whole period, 1st Jan 2004 to 31st October 2008, test whether there have been significantly lower prices in the last week of each month. Interpret your finding. (No more than one page) Each question ask has an equal weight in the final mark.

|

|

|||

| 网站地图 |