|

(1) Miller and Modigliani’s dividend irrelevancy proposition

米勒和莫迪利亚尼的股利无关命题

Dividend policy is irrelevant to share value

股息政策是无关紧要的共享价值

Assumptions for model:

模型假设:

– 1 There are no taxes

有没有税收

– 2 There are no transaction costs

有没有交易成本

– 3 All investors can borrow and lend at the same interest rate

所有的投资者都可以在相同的利率借入和借出

– 4 All investors have free access to all relevant information

所有的投资者都可以免费使用所有相关信息

– 5 Investors are indiff erent between dividends and capital gains

投资者之间的股息和资本收益都无动于衷

• Any money paid out could quickly be replaced by having a new issue of shares

可以迅速取代有一个新发行股份支付任何钱

• ‘Homemade dividends’

自制股息

Dividend irrelevance example

股利无关的例子

http://www.ukassignment.org/dxygassignment/

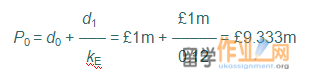

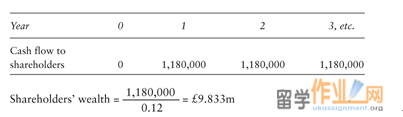

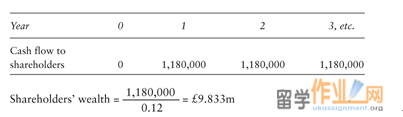

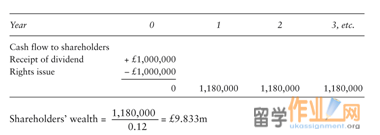

• Belvoir plc, an all-equity company which has a policy of paying out all annual net cash flow as dividend.

贝尔沃PLC,所有股权投资公司,其中有一个政策,所有年度的现金流量净额为股息支付.

• Expected to generate a net cash flow of £1m to an infinite horizon.

预计产生的现金流量净额100万英镑到无限的地平线。

• Cost of equity capital is 12 per cent

权益资本成本为12%

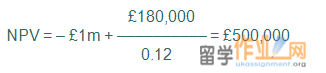

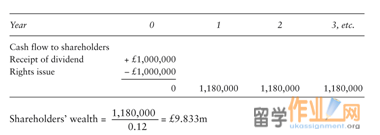

• A new investment opportunity. Which will produce additional cash flows of £180,000 per year starting in one year.

新的投资机会。这将产生每年180,000英镑的额外现金流量在一年内开始。

• The company will be required to invest £1m now.

现在,该公司将须投资100万英镑。

Belvoir plc

贝尔瓦有限公司

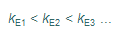

The project is financed through the sacrifice of the present dividend

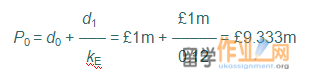

If the project is financed through a rights issue while leaving the dividend pattern intact

(2) Dividends as a residual

股利作为剩余

• Imagine that the raising of external finance is so expensive that to all intents and purposes it is impossible.

试想一下,提高外部融资是如此昂贵,所有意图和目的,这是不可能的。

• In this world dividends should only be paid when the firm has financed all its positive NPV projects.

在这个世界上股息应该只当公司已支付其所有净现值为正的项目提供资金。

• In these circumstances dividend policy becomes an important determinant of shareholder wealth:

在这种情况下,股息政策成为股东财富的重要决定因素:

– 1 If cash flow is retained and invested within the firm at less than kE, shareholder wealth is destroyed; therefore it is better to raise the dividend payout rate.

如果该公司在不到kE保留现金流量和投资,股东财富被破坏,因此,它是更好地提高股息支付率。

– 2 If retained earnings are insufficient to fund all positive NPV projects shareholder value is lost, and it would be beneficial to lower the dividend.

如果留存收益不足以支付所有净现值为正的项目股东价值丢失,这将有利于降低股息。

What about the world in which we live?

我们生活在其中的世界是什么?

Transaction costs

交易成本

• Taxes further complicate the issue

税问题进一步复杂化

• Dividend policy makes some difference to shareholder wealth

股息政策使一些股东财富的差异

• Young rapidly growing firms with a need for investment finance have a very low dividend (or zero) payouts, whereas mature ‘cash cow’ type firms choose a high payout rate

年轻的快速成长型企业与金融投资需要有一个非常低的股息(或零)的支出,而成熟的“摇钱树”类型的企业选择高派息率

• Zero dividend firms?

零股息公司吗?

Some influences on dividend policy

一些对股利政策的影响

• Clientele effects – do dividend-loving groups acquire shares in dividend-payers, or buy shares and lobby the firm?

顾客服务效果 - 做爱好股息群体股息的纳税人,收购股份或购买股份及游说公司吗?

• Pressure on the management to produce a stable and consistent dividend policy

管理上的压力,产生一个稳定和一致的股息政策

• Most firms seem to have a consistent dividend policy based on a medium- or long-term view of earnings and investment capital needs. The shortfalls and surpluses in particular years are adjusted through other sources of finance

大多数企业似乎有一个一致的股息政策在中期或长期的收入和投资资金需求。特别是通过调整其他融资来源的短缺和盈余

• Taxation?

税项?

• Dividends tax rate versus capital gains tax rate

股息率与资本利得税税率

• Dividends as signals – price reactions to dividend rise?

股息信号 - 价格股息上升的反应?

(3) Resolution of uncertainty

不确定性解决

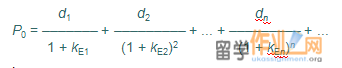

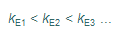

• Imperfect perceptions - Myron Gordon (1963) argued that investors perceive that a company, by retaining and reinvesting a part of its current cash flow, is replacing a certain dividend flow to shareholders now with an uncertain more distant flow in the future

不完善的看法 - 迈伦•戈登(1963)认为,投资者认为一家公司,通过保留和再投资的一部分,其目前的现金流,更换若干股息流股东在未来一个不确定的流量更遥远的

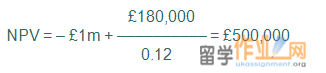

• :. The market places a greater value on shares offering higher near-term dividends (i.e. relatively undervalues payments further in the future).

市场更大的价值,提供更高的短期股息(即相对低估付款,在未来的进一步)股份。

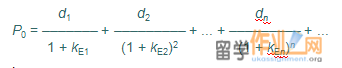

where:

• Perceived risk

感知风险

• Counter-attacks on the ‘bird-in- the-hand fallacy’

反击“鸟在手谬误”

• Take a company which pays out all its earnings in the hope of raising its share price because shareholders have supposedly had resolution of uncertainty chat row needs to invest

股东以公司支付其所有盈利的希望提高其股价,因为据说有分辨率不确定性聊天行需要投资

(4) Owner control (agency theory)

所有主控制(代理理论)

• Many firms seem to have a policy of paying high dividends, and then, shortly afterwards, issuing new shares to raise cash for investment

很多企业似乎有支付高额股息政策,然后,不久之后,发行新股以筹集现金用于投资

• One possible answer is signalling

一个可能的答案是传递信息

• A second potential explanation lies with agency cost

第二个可能的解释在于代理成本

• Owners insist on relatively high payout ratios. Then, if managers need funds for investment they have to ask

业主坚持相对较高的派息率。然后,如果管理者需要资金进行投资,他们不得不问

(Agency costs)

(代理成本)

• Agency costs are the direct and indirect costs of attempting to ensure that agents act in the best interest of principals as well as the loss resulting from failure to get them to act this way

代理成本的直接和间接成本,试图确保代理商的最佳利益的校长,以及从失败中造成的损失,让他们这样的行为采取行动

• Agency costs for lenders

贷款人的代理成本

• Information asymmetry

信息不对称

• Lenders will require a premium on the debt interest to compensate for the additional cost of monitoring

贷款人会要求一个溢价的债务利息,以弥补额外的监控成本

• Restrictions (covenants) built into a lending agreement

• 限制建成借贷协议(契约)

• Psychological element related to agency costs; managers do not like restrictions placed on their freedom of action

心理因素与代理成本;经理不喜欢限制他们的行动自由

|