|

Share buy-backs and special dividends

股份回购和特别股息

• Repurchasing shares can be used to rapidly raise the debt level.

购回股份,可以用来迅速提高债务水平。

• Buy-backs may also be useful when the company is unsure about the sustainability of a possible increase in the normal cash dividend.

回购也可能是有用的,不确定时,该公司可能增加的正常现金股息的可持续性。

• Special dividend, same as a normal dividend but usually bigger and paid on a one-off basis.

特别股息,作为一个正常的股息相同,但通常更大,支付一次性的基础上。

• A special dividend has to be offered to all shareholders. A share repurchase can be accomplished in one of three ways:

特别股息,必须向所有股东提供。 A股回购可以实现以下三种方式之一:

– a purchasing shares in the stock market;

在股市购买股份

– b all shareholders are invited to tender some or all of their shares;

所有股东均获邀投标的部分或全部股份

– c an arrangement with particular shareholders.

安排特别股东

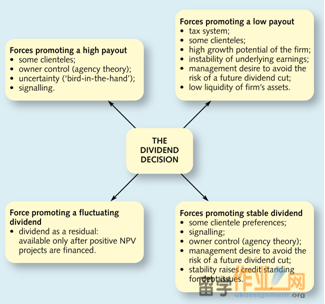

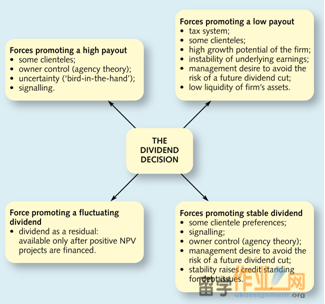

The forces pulling management in the dividend decision

在股息决策中的力量拉扯管理

A round-up of the arguments

论点的聚集

• Question 1 Can shareholder wealth be increased by changing the pattern of dividends over a period of years?

问题:1可以变着花样的股息几年内增加股东财富?

• Question 2 Is a steady, stable dividend growth rate better than one which varies from year to year depending on the firm’s internal need for funds?

问题2是一个稳定的,稳定的股利增长率优于每年根据对公司的内部资金需求变化?

A possible practical dividend policy

一种可能的实际股息政策

http://www.ukassignment.org/dxygassignment/

• Forecast fixed capital expenditure and additional investment in working capital as well as sales, profits, etc. Allowing an estimation of medium- to long-term cash flows

预测固定资本开支及营运资金的额外投资,以及销售,利润等,使中期至长期的现金流量估计

• Determine dividend level that will leave sufficient retained earnings to meet the financing needs of investment projects without having to resort to selling shares–a maintainable regular dividend

确定分红水平,将留下足够的留存收益,以满足投资项目的融资需求,而不必诉诸售股份可维护定期股息

• Dividends may be set at a level low enough that, if poorer trading conditions do occur, the firm is not forced to cut the dividend

股息可设置足够低的水平,如果发生的交易条件较差,该公司被迫削减股息

• In years of plenty directors can pay out surplus cash in the form of special dividends or share repurchases

在多年的大量董事特别股息或购回股份的形式支付现金盈余

• Make a gradual adjustment

一个渐进的调整

• Provide as much information to investors as possible

投资者尽可能提供多的信息

Lecture review

讲座回顾

• Dividend policy

股息政策

• Miller and Modigliani: the policy on dividends is irrelevant to shareholder wealth

米勒和莫迪利亚尼的股息政策是股东财富无关

• In a world with no external finance dividend policy should be residual

世界上有没有外部融资股息政策应该是残留

• Clientele effect

客户效应

• Taxation

税收

• Dividends can act as conveyors of information

股息可以作为输送机的信息

• ‘Resolution of uncertainty’

“不确定性”的决议

• Owner control

所有者控制

• Share repurchase

购回股份

• Special dividend

特别股息

Sources

来源

Arnold

Lumby & Jones (2003) Corporate Finance: theory and practice (7th ed.) Ch.22 ‘The Dividend Decision’

|