|

The required rate of return

要求的回报率

• The capital provided to large firms comes in many forms

提供给大型企业的资本以多种形式出现

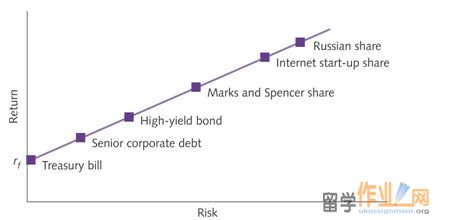

• The rate of return offered on government bonds and Treasury bills is the bedrock rate that is used to benchmark other interest rates. It is called the risk-free rate of return, given the symbol rf

政府债券和国库券的回报率是基岩率,用于其他基准利率。这就是所谓的无风险回报率,给出的象征rf

• The cost of debt capital for a corporation kD, is:

公司债务资本成本kD,是:

kD = rf + RP

• If the current risk free rate is 6 per cent, then kD = 7 per cent for a company paying 100 basis point over the Treasury rate

如果当前的无风险利率为6%,则KD=7%的公司支付国债利率100个基点

• If the firm already has a high level of debt it may need to offer, say, 300 basis points above the risk-free rate

如果企业已经具有较高的债务水平,可能需要提供,也就是说,300个基点以上的无风险利率

kD = rf + RP = 6 + 3 = 9%

Range of risk and returns

风险和回报的范围

• If the form of finance provided is equity capital then the investor is accepting a fairly high probability of receiving no return

如果提供融资的形式是权益资本,那么投资者接受没有收到回报的概率相当高

• On the other hand, if the firm performs well very high returns can be expected.

另一方面,如果企业做得好,可以预期回报率非常高。

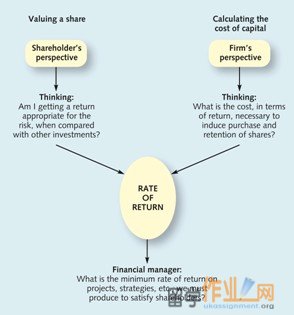

Two sides of the same coin

一枚硬币的两面

Cost of equity capital

权益资本成本

kE = cost of equity / return

kE =股权成本/回报

From share valuation model above

从上述股的估值模型

P0 = D1/(r-g) which implies

(r-g) = D1/ P0 so that

r = D1/ P0 + g

We can therefore estimate that the cost of equity is roughly related to D1/P0 (dividend yield) plus g (capital gains yield = capital growth rate)

因此,我们可以预计,股权成本大致相关D1/P0(股息收益率)加上克(资本利得收益率=资本增长率)

It is possible to estimate these using market data in order to set an ‘appropriate’ equity return to satisfy investors

估计这些为了设置一个'适当'的股本回报,以满足投资者利用市场数据,这是可能的

Cost o f debt capital

债务资本成本

http://www.ukassignment.org/assignmentgs/

Cost of debt can be stated in a number of ways

在多种方式中可以说债务成本

kD = cost of debt

kD =债务成本

This is the version in the original model but is a little simplistic, as it ignores the tax advantage of debt over equity. We therefore examine the cost of debt give the ‘tax shield’ that debt receives…

这是在原有机型的版本,但有点简单化,因为它忽略了税收优势债务权益。因此,我们研究债务成本带来的“税盾”,该债务接收..

kDBT = cost of debt (before tax)

kDAT = cost of debt (after tax)

If t = tax rate, then

kDAT = kDBT.(1-t)

WACC

加权平均资本成本

The total Weighted Average Cost of Capital is:

WACC = (E/V). kE + (D/V). kDBT.(1-t)

or

WACC = WE. kE + WD. kDAT

The weighted average cost of capital (WACC)

加权平均资本成本

• A corporation is to be established by obtaining one-half of its £1,000 million of capital from lenders, who require an 8 per cent rate of return for an investment of this risk class, and one-half from shareholders, who require a 12 per cent rate of return

• 拟设立股份公司从贷款人是通过获得其1000万英镑的资金的一半,需要这种风险类投资的回报率8%,和二分之一的股东,需要一个12%回报率

Cost of debt kD = 8%

Cost of equity kE = 12%

Weight of debt VD/(VD + VE) £500 million / £1 billion WD = 0.5

Weight of equity VE/(VD + VE) £500 million / £1 billion WE = 0.5

VD = Market value of debt, VE = Market value of equity

Weighted average cost of capital, WACC = kE WE + kD WD

WACC = (12 × 0.5) + (8 × 0.5) = 10%

Sources

来源

Basics

基础

Jones, M. (2006) Accounting. (2nd ed., Wiley) Ch.22

Advanced texts:

高级文本

Arnold, G. (2005) Corporate Finance Management (3rd ed., FT Prentice Hall) Ch.19

Lumby , S., & Jones, C. (2003) Corporate Finance: theory and practice (7th ed., Thomson) Ch.17

Ross, S.A., Westerfield, R.W. & Jordan, B.D. (1999) Fundamentals of Corporate Finance (4th ed., McGraw-Hill) Chs.8 & 14

|