|

Lecture 5 pt 2 – Cost of Capital part 2

讲座5 - 2 -资本成本第2部分

ID4246M Business Finance

Dr V G Fitzsimons

University of Bradford

ID4246M商务财经

V G菲茨西蒙斯博士

布拉德福德大学

The capital-asset pricing model (CAPM)

资本资产定价模型(CAPM)

•The risk premium has generally been adjusted by a beta based on the extent to which a share had moved when a market index moved

风险溢价已普遍被调整时根据每股搬到的程度由一个测试市场指数移动

kE = rf + b (rm – rf )

•Beta is less than perfect

测试版不完美

http://www.ukassignment.org/dxygassignment/

The Gordon growth model method for estimating the cost of equity capital

估算权益资本成本的戈登增长模型方法

•A company’s shares, priced at P, produce earnings of E per share and pay a dividend of d per share

公司的股份,价格为P,生产盈利每股电子和d的每股派发股息

•The company has a policy of retaining a fraction, , of its earnings each year

公司拥有的政策,保留一小部分,b,其每年盈利

•Under certain restrictive conditions, it can be shown that earnings, dividends and reinvestment will all grow continuously, at a rate of g = br, where r is the rate of return on the reinvestment of earnings

在某些限制条件下,它可以盈利,股息和再投资都将持续增长,以g = br的速度,其中r是盈利的再投资回报率的速度

•We can derive g in other ways

我们可以在其他方面得到

•Problem obtaining a trustworthy estimate of the future growth rate

获得一个值得信赖的估计未来增长率的问题

Retained earnings and debt

保留盈利及债务

•The cost of retained earnings

留存收益成本

•The cost of debt capital

债务资本成本

The cost of debt is generally determined by the following factors:

债务成本一般是由以下因素决定:

–The prevailing interest rates

现行利率

–The risk of default

违约风险

–The benefit derived from interest being tax deductible

来自利息扣税的好处

Traded debt

交易债务

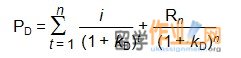

•UK bonds are normally issued with a nominal value of £100

i = annual nominal interest (coupon payment)

Rn = amount payable upon redemption

kD = cost of debt capital (pre-tax benefit)

PD = current market price of bond

Cost of traded debt example - Elm plc

交易债务成本举例-ELM邮箱公司

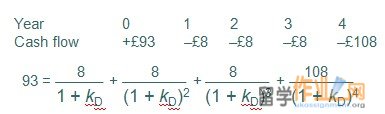

•Elm plc issued £100m of bonds six years ago carrying an annual coupon rate of 8 per cent

•Due to be redeemed in four years for the nominal value of £100 each

•The next coupon is payable in one year and the current market price of a bond is £93

Elm plc

ELM 有限公司

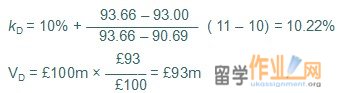

With kD at 11 per cent the discounted cash flow on the right hand side = 90.69.

With kD at 10 per cent the discounted cash flow on the right hand side = 93.66.

•It would be wrong to use the coupon rate of 8 per cent on the bond for the cost of debt

kDAT = kDAT (1 – T)

kDAT = 10.22 (1 – 0.30) = 7.15%

Cost of finance

融资成本

•Financial Times,

金融时报

•Untraded debt

无成交债务

•Floating-rate debt

浮动利率债务

•The cost of preference share capital

优先股股本成本

•Hybrid securities

混合证劵

|