|

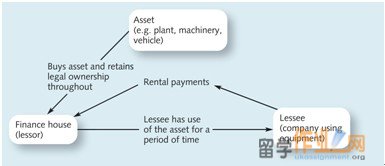

Leasing

租赁

Types of Lease

租赁的类型

• Operating lease

经营租赁

– Short-term contract

– 短期合同

– Not expected to last for the entire useful life of the asset

– 预计不会持续整个使用寿命的资产

– Finance house bears the risk of ownership

– 财务房子承担所有权风险

• Finance lease

• 融资租赁

– The finance provider expects to recover the full cost (or almost the full cost) of the equipment, plus interest, over the period of the lease

– 融资提供者预期收回设备的全部费用(或几乎全部费用),加上利息,在租赁期内

– No right of cancellation or termination

– 没有权利取消或中止

– The lessee will to bear the risks and rewards that normally go wit h ownership

– 承租人将要承担的风险和报酬通常与所有权

– The lessee is responsible for maintenance, insurance, repairs and absolescense

– 承租人负责维修,保险,维修

– A primary and a secondary period

– 初级和次级期间

http://www.ukassignment.org/dxygassignment/

Advantages of leasing

租赁的优点

• Advantages listed for hire purchase also apply to leasing: small initial outlay, certainty, available when other finance sources are not, fixed-rate finance and tax relief

• 租购上市的优点同样适用于租赁:初始费用小,确定性,可当其他融资来源,固定利率融资和税收减免

• For operating leases transfer of obsolescence risk

• 对于经营租赁的产品过时的风险转移

• Tax rules

• 税务规则

– Finance leases have to be ‘capitalised’ to bring them on to the balance sheet

– 融资租赁有'资本化',要送他们的资产负债表

– The asset is depreciated

– 资产折旧

– The liability is reduced

– 减少负债

– Depreciation and interest are both deducted as expenses

– 折旧和利息都作为费用扣除

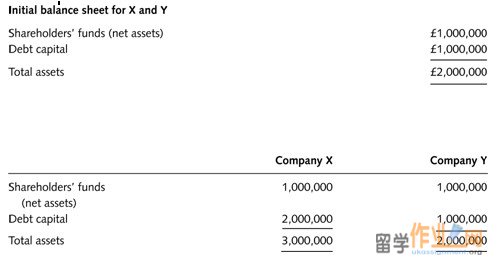

Off-balance sheet financing

资产负债表外融资

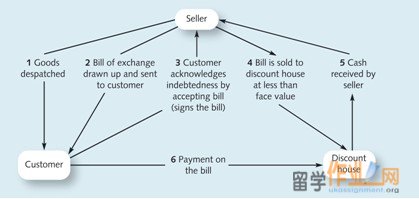

Bills of exchange

汇票

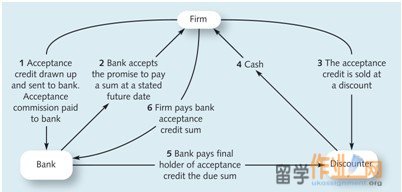

Acceptance credits

承兑信贷

Trade Debtor Management

贸易应收账款管理

• Trade debtor trade-off

• 贸易应收账款的权衡

• Credit policy

• 信贷政策

• Assessing credit risk

• 评估信贷风险

• Agreeing terms

• 同意条款

• Collecting payment

• 代收代缴

• Integration with other disciplines

• 与其他学科的整合

|