|

Corporate FinancialManagement, 3rd edition

企业财务管理,第三版

Glen Arnold

Lecture 1

讲座1

The objective of the firm

公司的目标

• Describe alternative views on the purpose of the business and show the importance to any organisation of clarity on this point.

• 描述业务的目的,不同的观点,在这一点上,显示清晰任何组织的重要性。

• Draw a distinction between profit maximisation and shareholder wealth maximisation.

• 绘制利润最大化和股东财富最大化之间的区别。

• Describe the impact of the divorce of corporate ownership from day-to-day managerial control.

• 描述从一天到一天的管理控制的企业所有权分离的影响

• ‘In whose interests is the firm run?’

• 公司运行的是谁的利益?

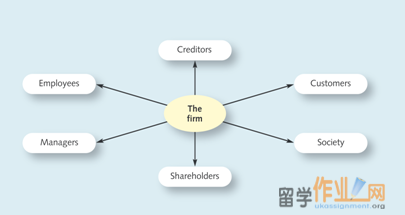

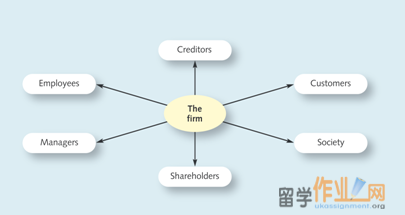

Exhibit 1.1 A company has responsibilities to a number of interested parties

图表1.1公司有一些利益相关集团有关责任的方面

A conflict between objectives

目标之间的冲突

• Which claimants are to have their objectives maximised, and which are merely to be satisficed?

• 原诉人是有自己的目标最大化,哪些是仅仅是满意的吗?

• Pro-capitalist economists

• 临资本主义经济学家

– The rules of the game

– 游戏规则

• Left-wing

• 左翼

– Primacy of workers’ rights and rewards

– 工人的权利和回报的首要地位

• Balanced stakeholder approach

• 平衡利益相关者的做法

Some possible objectives

一些可能的目标

• Achieving a target market share

• 实现的目标市场份额

• Keeping employee agitation to a minimum

• 保持员工煽动到最低限度

• Survival

• 生存

• Creating an ever-expanding empire

• 创建一个不断扩大的帝国

• Maximisation of profit

• 利润最大化

• Maximisation of long-term shareholder wealth

• 长期股东财富最大化

The assumed objective for finance

假设融资目标

http://www.ukassignment.org/dxygassignment/

The company should make investment and financing decisions with the aim of maximising long-term shareholder wealth.

与使长期股东财富最大化的目标,公司应使投资和融资决策。

• The practical reason

• The theoretical reasons

– The ‘contractual theory’

– Practicalities of operating in a free market system

– Society is best served by businesses focusing on returns to the owners

Adam Smith (1776)

亚当•斯密(1776年)

“The businessman by directing . . . industry in such a manner as its produce may be of the greatest value, intends only his own gain, and he is in this, as in many other cases, led by an invisible hand to promote an end which was no part of his intention. Nor is it always the worse for society that it was no part of it. By pursuing his own interest he frequently promotes that of the society more effectually than when he really intends to promote it…”

“商人的指导。 。 。以这样的方式作为其生产的行业可能是最大的价值,打算只考虑自己的利益,他是在这里,就像在其他许多情况下,一只看不见的手的带领下,以促进到底哪个是没有他的意图的一部分。也不是总是差为社会,这是它的任何部分。通过追求自己的利益,他经常促进了社会更有效地比,当他真的打算推动它......“

Michael Jensen

迈克尔•詹森

• Attacks the stakeholder approach (and its derivative, the Balanced Scorecard of Kaplan and Norton (1996)). Criticisms include:

• 攻击利益相关者的方法(及其衍生物,卡普兰和诺顿的平衡计分卡(1996))。批评包括:

- 混乱造成的多重目标瞄准

– Confusion resulting from a multiplicity of targets to aim for

– Leaving managers unaccountable for their actions

– Allowing managers to pursue their own interests at expense of the firm

• However, Jensen argues that companies cannot create shareholder value if they ignore important constituencies.

• 然而,詹森认为,企业不能为股东创造价值,如果他们忽视了重要的选区。

– They must have good relationships with customers, employees, suppliers, government etc.

• Simply telling people to maximise shareholder value is not enough to motivate them to deliver value.

• 简单地告诉人们,实现股东价值最大化是不够的,激励他们创造价值。

– They must be turned on by a vision or a strategy.

More thoughts on the key objectives

关键目标的更多想法

约翰•凯

-

•米尔顿•弗里德曼(Milton Friedman)

-

-

•

• John Kay

– Firms going directly for ‘shareholder value’ may do worse for shareholders than those that focus on vision and excellence first and find themselves shareholder wealth maximisers in an oblique way.

– “股东价值”的企业直接可以做股东差比那些眼光和卓越的重点首先发现自己在斜向方式的股东财富最大化。

• Milton Friedman

– Businesses should pursue high returns for owners. This results in the best allocation of investment capital among competing industries and product lines.

– 企业应为业主追求高回报。这将导致竞争的行业和产品线之间的投资资金的最佳配置。

- 消费者结束了他们想要的东西,因为稀缺的投资资金的最佳用途。

– Consumers end up with more of what they want because scarce investment money is directed to the best uses.

– 员工自身利益往往会保留他们的工作这一压倒一切的目标相冲突。

– The self-interest of employees in retaining their jobs will often conflict with this overriding objective.

– 推进上述所有其他股东的利益的一个强有力的理由是他们自己的公司,所以值得它产生的任何盈余。

• One powerful reason for advancing shareholders’ interests above all others is they own the firm and so deserve any surplus it produces.

• 推进上述所有其他股东的利益的一个强有力的理由是他们自己的公司,所以值得它产生的任何盈余。

|