|

ABF305 Investment Management

ABF305投资管理

Term 1, Workshop 6 Group Assignment (Total 12.5 marks)

第1学期,研讨会6团队作业(总计12.5分)

NB: The deadline for you group workshop assignment submission is Wednesday the 8th February before 12 noon at the Faculty Support Office (Level 3 CKY). Please clearly state on a cover sheet: (1) your group number; (2) student names; (3) student ID numbers; (4) module course name; and (5) the date and time when you submitted your assignment.

注:各研讨会作业提交的截止日期为2月8日周三学院支援办公室(3级CKY)中午12点之前。请在封面上明确规定:(1)你的组数;(2)学生的姓名;(3)学生的ID号;(4)模块课程名称及(5)提交祖业的日期和时间。

Question 1

ABF305 Investment Management

ABF305投资管理

Term 1, Workshop 6 Group Assignment (Total 12.5 marks)

第1学期,研讨会6团队作业(总计12.5分)

NB: The deadline for you group workshop assignment submission is Wednesday the 8th February before 12 noon at the Faculty Support Office (Level 3 CKY). Please clearly state on a cover sheet: (1) your group number; (2) student names; (3) student ID numbers; (4) module course name; and (5) the date and time when you submitted your assignment.

注:各研讨会作业提交的截止日期为2月8日周三学院支援办公室(3级CKY)中午12点之前。请在封面上明确规定:(1)你的组数;(2)学生的姓名;(3)学生的ID号;(4)模块课程名称及(5)提交祖业的日期和时间。

Question 1

问题1

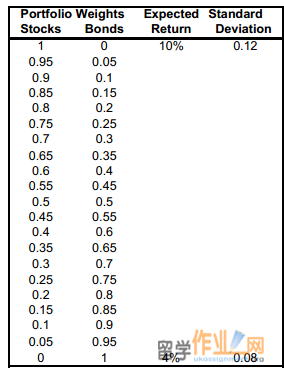

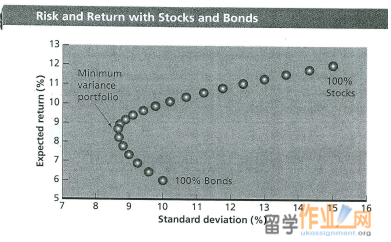

A portfolio of stocks has an expected return of 10 percent and a standard deviation of 12 percent. A portfolio of bonds has an expected return of 4 percent and a standard deviation of 8 percent. The correlation between the returns on the two funds is 0.20. Employing this information and the information provided, fill in the blanks in the table below. Using the information you have determined, create a Markowitz efficient frontier for the opportunity set for a portfolio of the two assets. On your frontier, indicate the minimum variance portfolio.

股票组合的期望报酬率10%,标准差为12%。债券的一个投资组合的期望报酬率4%和8%的标准偏差。这两只基金的回报率之间的相关性为0.20。采用这种信息和提供的资料,填写在下面的表格中的空白。使用你已经确定的信息,创建一个马克维茨有效前沿的两个资产组合的机会。在你的前沿,表明最小方差组合。

Solution:

The following formula should be used: For the expected return it is just the weighting so

(0.95 * 0.10) + (0.05*0.04) =

For the standard deviation which is variance using this formula and then the squared root.

The minimum variance portfolio should be 0.072249567

Question 2

Explain in your own words what the Markowitz efficient frontier demonstrates and how it can be used in investment management. (6 marks)

问题2

自己的话解释什么马克维茨有效前沿演示,它可以用来在投资管理方式。 (6分)

Solution:

In regards to what you could have said: an example might be as follows:

In essence, the model shows the power of diversification, or more specifically, efficient diversification. The Markowitz efficient frontier demonstrates the properties of portfolios specifically, whereby through the efficient frontier, it identifies that for an investment set, not all are efficient. Portfolio properties can best be demonstrated by a numerical example which shows the effects of correlation. With respect to the Markowitz efficient frontier, it can be used in investment management to arrive at an optimal risky portfolio. The portfolios represented on the ‘Efficient’ frontier represent efficient investment sets which may be considered. The point of determining the minimum-variance portfolio is that it highlights any portfolio lying below it can be rejected out of hand as inefficient, while any portfolio above it is efficient and can be considered.

http://www.ukassignment.org/dxygassignment/

Comments and Feedback

意见及反馈

This assignment was well done by most groups. Both the numerical calculations and explanation for the Markowitz efficient frontier was well answered.

这次作业大部分团队完成的很好。数值计算和解释马克维茨有效前沿是很好的回答。

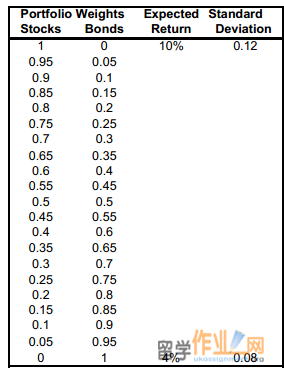

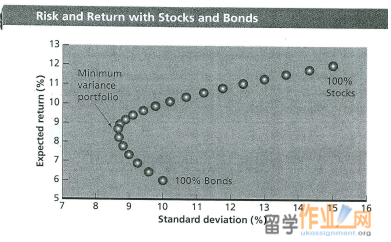

A portfolio of stocks has an expected return of 10 percent and a standard deviation of 12 percent. A portfolio of bonds has an expected return of 4 percent and a standard deviation of 8 percent. The correlation between the returns on the two funds is 0.20. Employing this information and the information provided, fill in the blanks in the table below. Using the information you have determined, create a Markowitz efficient frontier for the opportunity set for a portfolio of the two assets. On your frontier, indicate the minimum variance portfolio.

股票组合的期望报酬率10%,标准差为12%。债券的一个投资组合的期望报酬率4%和8%的标准偏差。这两只基金的回报率之间的相关性为0.20。采用这种信息和提供的资料,填写在下面的表格中的空白。使用你已经确定的信息,创建一个马克维茨有效前沿的两个资产组合的机会。在你的前沿,表明最小方差组合。

Solution:

The following formula should be used: For the expected return it is just the weighting so

(0.95 * 0.10) + (0.05*0.04) =

For the standard deviation which is variance using this formula and then the squared root.

The minimum variance portfolio should be 0.072249567

Question 2

问题2

Explain in your own words what the Markowitz efficient frontier demonstrates and how it can be used in investment management. (6 marks)

自己的话解释什么马克维茨有效前沿演示,它可以用来在投资管理方式。 (6分)

Solution:

In regards to what you could have said: an example might be as follows:

In essence, the model shows the power of diversification, or more specifically, efficient diversification. The Markowitz efficient frontier demonstrates the properties of portfolios specifically, whereby through the efficient frontier, it identifies that for an investment set, not all are efficient. Portfolio properties can best be demonstrated by a numerical example which shows the effects of correlation. With respect to the Markowitz efficient frontier, it can be used in investment management to arrive at an optimal risky portfolio. The portfolios represented on the ‘Efficient’ frontier represent efficient investment sets which may be considered. The point of determining the minimum-variance portfolio is that it highlights any portfolio lying below it can be rejected out of hand as inefficient, while any portfolio above it is efficient and can be considered.

Comments and Feedback

意见及反馈

This assignment was well done by most groups. Both the numerical calculations and explanation for the Markowitz efficient frontier was well answered.

这次作业大部分团队完成的很好。数值计算和解释马克维茨有效前沿是很好的回答。

|