|

ABF 305 INVESTMNET MANAGEMENT

SURGERY 4 Portfolio

AF305投资管理

调查4 投资组合

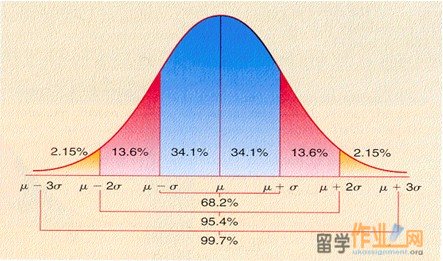

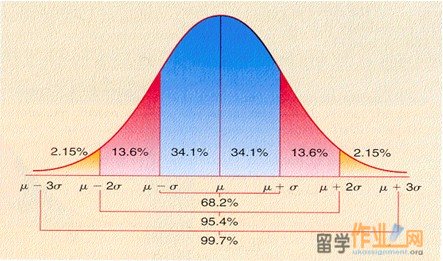

Normal Distribution

正态分布

Risk aversion

风险规避

• Risk-averse investors are willing to consider only risk-free or speculative prospects with positive risk premium.

风险规避投资者愿意只考虑无风险或投机性的前景与积极的风险溢价。

• Each investor can assign a welfare, or utility, score to competing investment portfolios based on the expected return and risk of those portfolio.

每一个投资者可以分配一个福利或效用,分数竞争的投资组合的预期收益和基于风险的投资组合。

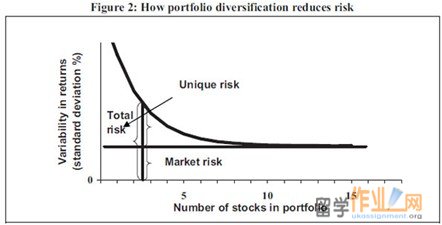

Diversification

多样化

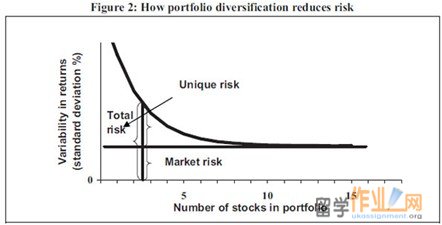

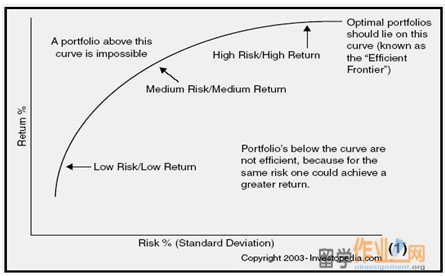

• Diversification is a strategy that you include many securities in your portfolio.

• Diversification will reduce risk, but not eliminate risk.

• The risk that can be eliminated is called unique risk, firm-specific risk, non-systematic risk, or diversifiable risk

• The risk that remains even after extensive diversification is called market risk.

• All securities are affected by the common macroeconomic factors.

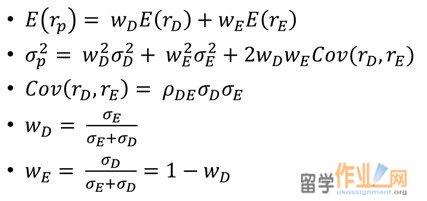

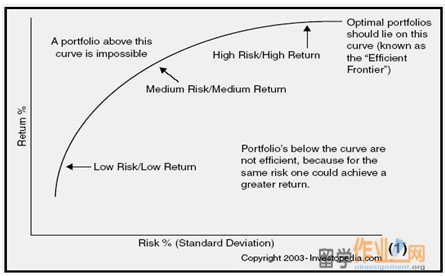

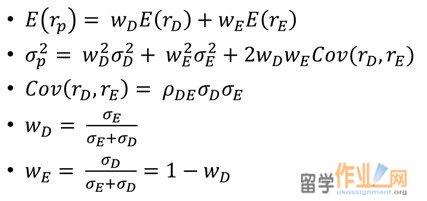

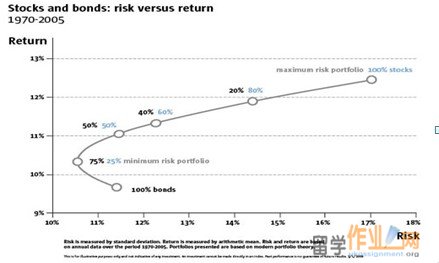

Portfolios of two risky assets

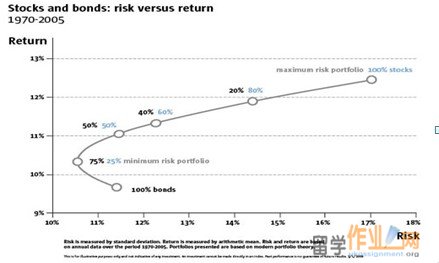

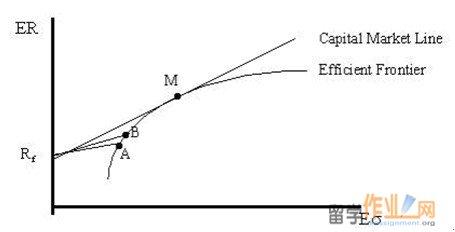

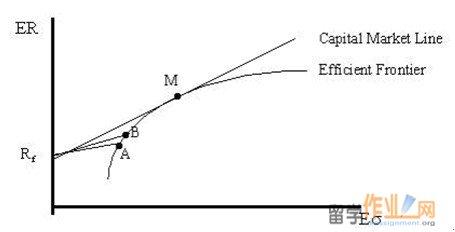

Capital Allocation Line (CAL)

资本配置线

Optimal Risky Portfolio

Optimal Complete Portfolio

|