|

ABF305 Investment Management

Review the in-class test.

Risk-return trade off.

The risk return trade-off or relationship can be represented by an equilibrium.

The return of the asset.

The return of an asset.

For stocks, the way to determine the rate of return, is from the dividend paid and also the capital gain or loss on the stock price.

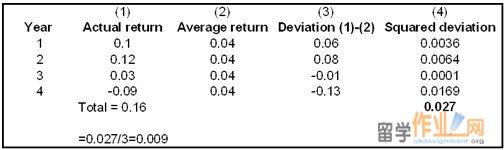

Effective annual return or EAR.

If you do not hold the shares for 1 year, then you will need to adjust the return accordingly. Let us say that you bought a share for $18 and held it for 3 months after which the price was $19; you received no dividend. Your holding period percentage return for three months is determined as 19-18/18 = 0.0555 or 5.56%. The risk of an asset. If risk is thought of in terms of the volatility of an asset’s returns, to quantify this risk, the return variance and standard deviation are employed. Specifically, variance and its square root which is known as the standard deviation, are the most commonly used measures of volatility. Remember volatility is unpredictability. The degree of movement of difference from an average return therefore represents a measure of just how unpredictable a return is.

How to calculate standard deviation.

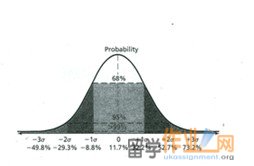

With an average return measure and standard deviation, employing a normal distribution which employs for these measures will tell you the probability of your return ending up in a given range.

We can quantify return and risk for a single stock.

|

|

|||

| 网站地图 |