|

指导英国ESSAY-英国留学生ESSAY指导 Methodology and data collection

1 Introduction

This research is to study the impact of FDI on the economical development evidence from China, so multilevel methods should be combined in this research. Regarding that some of the issues will be studied would be abstract, so qualitative approach and quantitative approach both are used here.

In order to narrow the research range, the author chooses China as the research place. After analysis the situation of Chinese economical development, the author will find out some effect of FDI on it.

This chapter is the research methodology in the whole dissertation. In order to get the correct data of Chinese economic development, secondary and primary methods are used for the author to get data and correct useful information.

Methodology refers to the approach or methods that are used in the research, (Blaxter et al 2001). The research method is concerned with the way in which data is collected and discussed to answer the research question. The most fundamental ways in research methods is primary and secondary research. (Saunders 2003)

In this dissertation, statistics websites, magazines, books, news and so on have been used for the secondary data collection, which the author thinks to be the appropriate strategy to achieve the objectives. Secondary research in this dissertation has been collected from various sources such as some journals, web news, newspapers, and books and so on; the authoritative website information is also used to acquire more up-to-date information, material and data. The combinations of primary and secondary research method are regarded as to be appropriate to the enquiry. As very few studies have been conducted into the effect of FDI on Chinese economical development, especially from the financial development point of view, it is relatively original. Emory and copper (1995) have explained that when the area of investigation is new, the researcher will need to conduct an exploration just to learn something about the problem and to be sure of the practicality undertaking the study. There is http://www.ukassignment.org/daixieEssay/daixieyingguoessay/limited information and studies on this subject and the problems now facing the issue in China. Therefore in order to get valid and reliable data from the economy in China, therefore it was greatly necessary to get authority data from the government statistics.

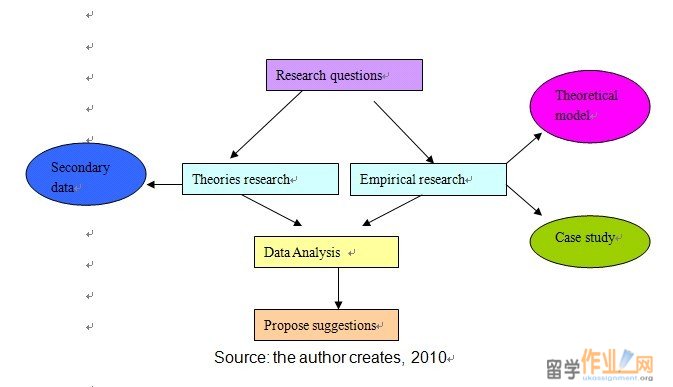

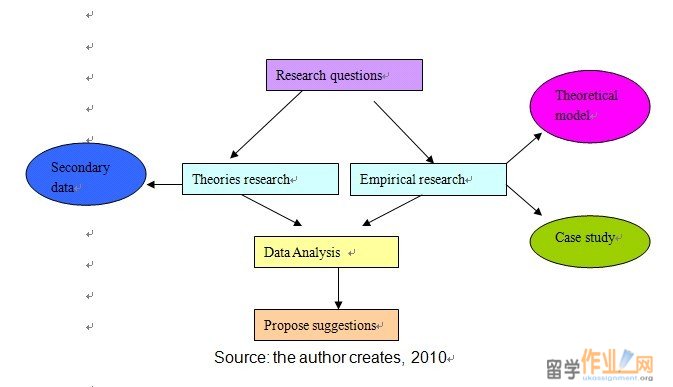

In order to clearly show the logic of the dissertation, the author creates a flow chart to indicate it:

Figure 3.1: Research logic flow chart

Source: the author creates, 2010

2 指导ESSAY Theoretical model#p#分页标题#e#

In this study, the author reads a lot of researches on FDI and economic growth, financial development and economic growth and FDI and economic growth in the perspective of financial development.

But the author mainly refers to the research and model done by Laura Alfaro, Areendam Chanda Sebnem, Kalemli Ozcan and Sayek Niels Selin (2003).

Laura Alfaro, Areendam Chanda Sebnem, Kalemli - Ozcan and SayekNiels Selin (2003) use 71 countries’ data during 1975-1995, choose five indexes to measure the domestic financial market development level, namely the financial system liquidity liabilities (LLY) namely M2 / GDP, commercial bank assets (BTOT) that commercial bank assets divide the sum of central bank asset and the commercial Banks’ assets, private bank loan (PRIVCR), namely the loan of financial intermediaries to the private sectors divide GDP, BANKCR, which means savings monetary bank loans to the private department divide GDP and stock volume/GDP. They use the measuring method to test and analyze the relationship between each index and “economic growth and FDI". After analysis they find out that good financial system and developed countries can fully and effectively use FDI. They further point out that FDI plays an important role in a country's economic growth. The developed countries with advanced financial system can gain significant positive effect from FDI. Conversely, if the financial system is vulnerable, contribution of FDI to the economic growth is small or even negative. In this dissertation, the author refers to Laura Alfaro’s research to set up theoretical model as the framework for FDI and economic growth.

Then the author uses the model, combines the data collected from the statistics database to test the model, and finds out the relationship between FDI and economic growth. Based on China's financial development, FDI and economic growth the author uses qualitative analysis method, uses the empirical data and materials as the basis, uses the latest statistics, pay attention to the consistency of the data, using caliber time series analysis method, in order to reflect the effect of financial market on the economic growth and FDI, namely with quantitative analysis.

1.1 指导ESSAY Assumption conditions

For convenience, the author makes constructs the following six hypotheses:

(1) host countries’ production departments are divided into FDI enterprises (YtFDI) and domestic private enterprises (YtD), every domestic private enterprise output depends on borrowing fixed capital investment S, fixed capital investment is more than the total assets of individuals, besides, domestic private enterprise’s output is influenced by agents' ability and foreign direct investment, the domestic private enterprises and FDI enterprises have relationship between personnel flow, competition with the FDI enterprises.

(2) The domestic private enterprises through learning, referring, imitating the FDI production departments’ advanced technology and management experience, make good use of the convenience factors of marketing network and enter the international market, to promote their own output increase. In certain conditions, more FDI and domestic private enterprises are, the more spillover effect FDI technology will have, conversely will smaller.#p#分页标题#e#

(3) P indicates host country’s domestic financial market development degree, which is a wedge value between the loan interest rate (r) and the real interest rate (i), showing the indirect costs of enterprises’ increased loans in financial markets’ low efficiency, such as mortgage lending constraints, guarantee, mortgages, and economic rent paid to obtain loans, etc.

(4) P value and number of agent choosing to establish new enterprises have inversely proportional relationship. P value increase will raise the threshold of a new enterprise established agent, thereby reducing the number of business, the number of people who choose work in foreign enterprises will increase. Conversely, P deduction will reduce the threshold agents choosing number of new enterprises, FDI enterprise and local private enterprises’ flows expand the spillover effect of FDI.

(5) Except for P and interest, domestic private enterprises’ other costs are zero.

(6) Agent ability E is for unit distribution, namely the domestic any Labor has the same ability, they both can start their private enterprises i, can also work in FDI department to get wage (w).

1.2 指导ESSAY Model deduction

(1) FDI production department’s production function

To assume that the FDI production department’s production function meets C.W.Cobb and Paul H. Douglas production function form, as follows:

(3.1)

In this formula, Lt refers to labor quantity employed by FDI production department, KtFDI means the capital investment of host country’s FDI department, A means the total factor productivity. In the balance period, foreign capital remuneration ‘r’ should be equal to the marginal outputs, so foreign investment can be deduced available as follows:

(3.2)

To change the format: (3.3)

The enterprises will decide the number of the optimal employees on the condition that the workers’ marginal productivity is equal to the salary (w).

(3.4)

To carry 3.3 into 3.4, we can get the following formula:

(3.5)

(2) Domestic enterprises’ production function

(3.6)

In which, EG refers to the minimum required ability value that establishing enterprises, Yti refers to enterprise I output

(3.7)

0 < y<1, 0< <1, Et means entrepreneur's actual ability, S stands for fixed capital investment. From the assumption (1) that fixed capital investment amount is more than the total assets of individuals, therefore, the new enterprises’ establishment needs from financial institutions to finance to compensate the self-owned capital’s shortage.#p#分页标题#e#

(3) Personal behavior choice

A country's population is composed by the continuous agents, everyone has different learning ability, agent i in time t’s learning ability is Eti, which belongs to the unit distribution, Eti ∈(0,1).Each agent’s initial wealth is M, and each agent’s initial wealth is equal. Agents face with two choices: to work in foreign enterprises, or to become entrepreneurs and to work in domestic production department.

If the agent chooses to work in foreign-funded enterprises, he or she will receive the regular wage income w, the final total wages in ti are equal for the sum of wages and assets returns, namely w+ (1 + r)M. as for those who chooses to establish the enterprise have to pay interest on the loan, the amount of loan is the difference between the fixed capital investment required for building new enterprises and the initial wealth, so in the final ti the net gain is for Yti -(1 + i) (S-M). Whether the agent chooses to work in foreign department or establish new business depends on the following conditions:

Working in foreign enterprises: (3.8)

To establish new enterprises: (3.9)

There is no difference working in both: (3.10)

(3.10) provides the critical value when the agent chooses where to work, to carry (3.6) into (3.10) can get the following formula:

(3.11)

The above formula can be changed into:

(3.12)

Only when the individual ability is more than EG then it is possible to set up their own enterprises, if ability value is lower than EG, then the agent will have to work in foreign departments to obtain employment, this means that the workforce number Lt that foreign departments employ is:

(3.13)

To carry (3.13) into (3.3), we can get the capital amount of foreign enterprises are:

(3.14)

To carry (3.14) into (3.12), (3.15)

In order to examine how the low efficiency of financial market to impact the agent to establish enterprise decisions, we introduce the Variable p into (3.15), which is to measure the degree of financial market development, because i= r +p, rearrange (3.15) available:

(3.16)

1.3 指导ESSAY Data collection

To evaluate economic growth for accounting, the author must obtain GDP, capital stock and labor input data. As for GDP data, it is based on the actual GDP (1978), the calculation method takes 1978 as the foundation and multiplies by the corresponding GDP index, obtains each year’s actual GDP data, From the China statistical yearbook periods can directly obtain related data; vintage labor.

|