|

Decision-making autonomy in multinational corporation subsidiaries operating in Scotland

Keywords

Decision making, Multinationals, Subsidiaries

Abstract

The increasing globalisation of markets has generated

new debates about the decision-making role of MNC

subsidiaries. Globalisation may be expected to result in

greater centralisation of the decision-making process. This

study analyses the extent to which subsidiaries are being

given control over a range of decisions. A sample of MNC

subsidiaries operating in Scotland was sent

questionnaires which dealt with financial, production,

employment and research and development decision

making. It was found that considerable authority was

devolved to subsidiaries in terms of operational decisions.

However, strategic decision making remained very much

under the control of the parent. This indicates that the

control systems being imposed on subsidiaries are 英国作业指导

selective and that the benefits created for local economies

may be not be as great as it initially appears.

Introduction

Inward investment, or foreign direct

investment (FDI), may be defined as the

process by which companies based outside a

particular geographic area invest in economic

activities within that area (Christodoulou,

1996). The expansion of FDI has led to

debates surrounding issues such as the degree

of external control and decision making,

particularly in terms of the type of control

exerted by parent companies. If control is

selective, subsidiaries may appear to have

more independence than they actually

possess. However, selective controls clearly

delineate the extent of local autonomy. It is

therefore important to identify the types of

control mechanisms imposed on subsidiaries

by multinational corporations (MNCs).

Baliga and Jaeger (1984) argue that

geographical dispersal should result in the

devolution of power to the managers of

subsidiaries. The key factor in such a policy is

that of local knowledge which means that the

subsidiary's managers and directors are better

informed than those situated in a different

geographical location. However, they also

highlight the main problem associated with

such delegation, namely that subsidiaries may

be run for the benefit of the local economy

rather than for the benefit of the parent's

shareholders. The types and extent of

decision making devolved to subsidiaries are

therefore of interest because they will

determine the impact of the inward

investment on the local economy. This is

particularly true given that operational

decisions are likely to be taken by the

subsidiary, while strategic decisions are likely#p#分页标题#e#

to be imposed by the parent company.

This paper analyses decision making within

MNC subsidiaries operating in Scotland. It

investigates how far Scottish subsidiaries have

autonomy in decisions relating to finance,

production, employment and research and

development. It will therefore assess the

extent to which selective controls are being

used to reduce the freedom of subsidiaries to

make strategic decisions while, at the same 苏格兰作业

time, allowing greater operational autonomy.

The paper is structured as follows. Next, the

literature relating to the key decisions involving

finance, production, employment and research

and development will be discussed. Then the

results of a survey will be presented. Finally

some conclusions will be drawn.

Financial decisions

Steuer et al. (1973) investigated the extent of

financial independence offered to MNC

subsidiaries. They found that it was possible

for subsidiaries to achieve greater autonomy

over certain aspects of financial control. For

example, if the subsidiary's assets increased,

the maximum capital expenditure which

could be undertaken, without reference to the

parent, increased. The same applied to higher

sales. Thus devolved responsibility increased

with firm growth. In spite of the fact that 90

per cent of subsidiaries experienced some

degree of centralised control, they concluded

that financial control was not tight.

In contrast, other studies have found that

financial decisions remained primarily under

the control of the parent. Van Den Buckle

and Halsberghe (1984), in their analysis of

decision making of MNC subsidiaries based

in Belgium, found financial decisions tended

to be centrally controlled. Young et al. (1985)

found that decisions concerning dividend

policy and royalty payments were by far the

most centralised aspect of financial decisionmaking

in foreign-owned subsidiaries

operating in the UK. There was, however,

greater decentralisation in the choice of

capital investment projects and in the

financing of these projects.

Thus, although Young et al. (1985) found

that UK subsidiaries appear to be granted

considerable levels of autonomy in respect to

the majority of financial decisions, it should

be noted that the subsidiaries often operated

within centrally determined financial targets.

This suggests that subsidiaries are subject to

selective controls on financial matters.

Locate in Scotland (1997) found that 47

per cent of firms surveyed claimed to have

total responsibility for capital investment

decisions with 37 per cent having partial

responsibility. However, it is not clear what is#p#分页标题#e#

meant by partial responsibility, because the

term is not defined in the study. It could,

therefore, be the case that the firms had only

minimal strategic responsibility.

Production and marketing decisions

Steuer et al. (1973) found that 70 per cent of

the subsidiaries were free to set prices without

interference from the parent company. This is

not unexpected given that a rapid reaction

may be necessary to cope with changing

market conditions. In these circumstances,

the subsidiary management's local knowledge

of market conditions would be invaluable and

authority to take action would be desirable.

Steuer et al. (1973) also looked at the

control of exports and found that there were

significant restrictions on the actions of

subsidiaries. In general, however, subsidiaries

were not given the authority to decide which

markets to enter. This strategic decision

tended to be taken by the parent. 英国作业指导

Young et al. (1985) found that there was a

high degree of autonomy with respect to

production and marketing decisions.

Operational issues such as volume output,

entering new UK markets, pricing policy and

advertising and sales distribution were among

the more decentralised decisions.

Locate in Scotland (1997) found that 91

per cent of subsidiaries claimed to have at

least partial responsibility over the production

and marketing decisions. There was also a

degree of independence in relation to the

purchasing decision with total responsibility

and partial responsibility being granted to the

subsidiary in 65 per cent and 23 per cent of

firms respectively. Young et al. (1985) found

that the parent company exerted a strong

influence in only 5 per cent of the subsidiaries

with respect to distribution and marketing

and sales decisions. In contrast, Locate in

Scotland (1997) found that 71 per cent and

70 per cent of subsidiaries claimed to have at

least have partial responsibility for marketing

and sales and distribution decisions

respectively.

In relation to marketing decisions, Wind

(1997) argued, that there is a greater

emphasis on being closer to the customer,

stressing customer satisfaction and building

customer relationships. Consequently, the

need for a common marketing philosophy to

be pursued throughout the whole

organization becomes more essential. The

marketing function becomes an integral part

of all employees' job descriptions, thus

increasing the apparent decentralisation of

marketing. It is, therefore, possible that there

will be an increase in the amount of autonomy

over marketing decisions devolved to the

subsidiary even though the strategic decisions#p#分页标题#e#

are still centrally determined. Thus

subsidiaries are given greater freedom but

within limits set by the parent.

Gates and Egelhoff (1986), in a study of

large US, UK and European MNCs, found

that if MNCs introduce more product lines in

foreign markets or modify products to meet local demand, then the decentralisation of

decision making is more likely to follow.

However, they also found that US MNCs

tended to pursue global marketing strategies

rather than local ones which suggests that

marketing decisions will become more, rather

than less, centralised. There may therefore be

geographical differences in the attitudes of

MNC parents to the extent of autonomy

granted to subsidiaries.

Collins and Schimenner (1997) maintain

that the single market has required many

organizations to review the way they operate

in Europe in relation to production and

marketing decisions. They identified

differences between the traditional

organization of manufacturing found in many

long-established European firms and the panregional

organization of the more progressive

European, and some Japanese and US,

companies operating in Europe.

The key characteristics of pan-European

manufacturers include a product based

strategy whereby different products are made

in different factories and then shipped to the

markets; increased market scope; and

decreased product scope. This pan-European

approach should result in increased attention

to product flows, the redesign of plant layout,

improved material handling, new investment

in equipment and the adoption of different

workforce practices. The increase in

transportation costs will be offset by benefits

such as the reduction in overheads gained

from greater specialisation and the minimum 指导英国作业

efficient scale of production may be achieved.

Such strategies are therefore expected to

lead to a reduction in the degree of autonomy

granted to subsidiaries. For example,

manufacturing units will become an

integrated part of a network of plants rather

than being regarded as an independent unit.

In addition, less control will be granted over

decisions such as the extension of product

ranges.

This is supported by Daniels and

Radebaugh (1998) who find that there is an

increasing trend for MNCs to adopt a global

sourcing policy. The purpose of this is to

achieve cost reductions, improvements in

quality, increased exposure to world-wide

technology and also delivery improvements.

Although this could result in additional costs

such as transportation costs increase, agent

fees and the introduction of, for example, Just

In Time systems, the increase would be more#p#分页标题#e#

than offset by overall cost savings. This also

suggests that there will be substantial control

over the purchasing policies of MNC

subsidiaries.

Employment and personnel decisions

Steuer et al. (1973) found that the

appointment of key personnel was often

subject to the discretion of the parent with

guidance sought from the subsidiary.

However, less senior appointments were

subject to increasing autonomy. This lends

weight to the view that there is a dual

approach to autonomy which sees the more

important decisions being retained by the

parent.

Hamill (1983) found that, in general,

employment and personnel decisions were

among the most decentralised decisions.

However, this did not extend to all decisions.

For example, Hamill showed that the parent

company exerted a strong influence through

codes and guidelines in relation to union and

non-unionisation decisions. This represents

indirect control rather than individual

decisions being forced upon the subsidiary.

Van den Buckle and Halsberghe (1984) also

found that employment and personnel

decisions in Belgium were highly

decentralised.

It can therefore be concluded that

employment and personnel decisions are

highly decentralised except in relation to the

appointment of senior executives. This again

shows that strategic decisions remain beyond

the scope of the subsidiary.

Research and development and

technology decisions

Hood and Young (1988) found that 40 per

cent of MNC subsidiaries located in the

British Isles conducted no activity in either

research or development. Even in subsidiaries

which undertook research and development,

the number of people employed was small.

They therefore concluded that research and

development was not only centrally controlled

but also centrally located.

Young et al. (1985) confirmed that research

and development and technology employed

were centrally controlled decisions. Almost

half of the subsidiaries claimed to be

decisively influenced by the parent company.

In addition, the research and development

involved was generally of a modification and

adaptation nature, rather than research aimed at development and innovation. Further

evidence for centralisation of research and

development was shown by Yao-Su (1992)

who found that that 83 per cent of German

MNC research and development personnel

was concentrated in the home nation.指导英国作业

De Meyer and Mizushima (1989) found

that there had been a significant change in the

attitude of MNCs to research and

development. Consistent with increased

globalisation, there had been an increase in

the decentralisation of research and#p#分页标题#e#

development decision making. Globalisation

should result in a greater need for local

technical support and therefore a greater

autonomy. However, they recognised that

centralisation may actually increase in certain

circumstances: in particular, when labs were

small and needed to be of a critical mass, if

firms had a centralised structure and if there

were time constraints.

Locate in Scotland (1997) found that in the

case of research and development and process

development, subsidiaries had at least partial

responsibility in 70 per cent and 82 per cent

of cases respectively. This increase in

responsibility is consistent with

Papanastassiou and Pearce (1997) who argue

that as global competitiveness intensifies,

MNCs need to be able to respond to changing

consumer demands in all major markets at an

ever increasing speed. This also includes

increasingly recognising the distinctive needs

of consumers in various world-wide markets.

By allowing subsidiaries to become more

responsive to these changing needs both the

MNC as a whole and the subsidiary will

benefit. The MNC as a whole can benefit

from a wider scope of knowledge, while the

subsidiary can benefit from the increase in

creative roles devolved to the subsidiary.

These benefits are unlikely to be gained if the

technology inputs remain within the domain

of the established technology function of the

MNC.

Methodology

Questionnaires were sent to a randomly

selected sample of 60 MNC subsidiaries

located throughout Scotland. The sample was

taken from a list of companies provided by

Locate in Scotland. The sample was split into

three sections, North American parent, Asian

Pacific parents and Continental European

parents. Of the 60 questionnaires sent out, 27

were returned. However, four of the returned

questionnaires were uncompleted. This gave

a usable response rate of 38 per cent. The

responses consisted of North American firms指导英语作业

± 30 per cent, Asian Pacific ± 26 per cent and

Continental European firms ± 44 per cent.

The questionnaire was split into four

sections. The first dealt with financial

decisions, the second with production and

marketing decisions, the third with

employment and personnel decisions and the

final section covered research and

development and technology decisions. The

questions asked covered strategic and

operational decisions and enable us to

ascertain the degree of autonomy over the two

types of decision.

The questionnaire gave four options for

each question: full responsibility of the

subsidiary: decided by the subsidiary after

consultation with the parent: decided by the#p#分页标题#e#

parent after consultation with the subsidiary:

and dictated by the parent. The results

reported combine the first two categories

which provides a measure of the degree of

autonomy enjoyed by the subsidiary. If the

percentages reported in the tables are high,

this indicates a significant degree of devolved

power. However, if they are low, this means

that most of the parents retain control over

that decision. The results will therefore

provide insights into the extent, and type, of

independence granted to Scottish-based

MNC subsidiaries in relation to the decisionmaking

process.

Results

Financial decisions

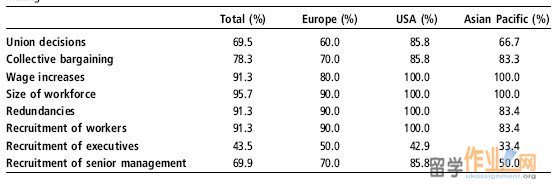

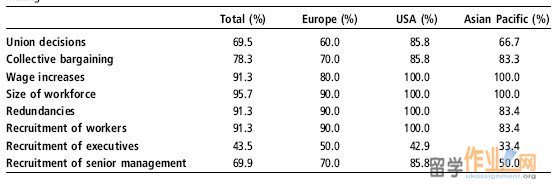

The first column of Table I shows that, for

the whole sample, many operational financial

decisions remain predominantly under the

control of the subsidiary. Decisions such as

the preparation of yearly accounts, the setting

of financial targets and the sale of fixed assets

are generally delegated to the subsidiaries.

The general devolution of financial decisions

is consistent with Steuer et al. (1973) and

Young et al. (1985).

However, parent companies tend to be

more involved in the determination of

strategic issues such as the target rate of

return on investment, a decision over which

only 43 per cent of subsidiaries had a

Table I Financial decisions ± percentage of subsidiaries with substantial autonomy in decision making

significant degree of autonomy. Decisions

about dividend policy and royalty payment

were also very much the domain of the parent

with no subsidiaries able to determine

dividend policy and only 21 per cent having

an input into the decision. These results

support Young et al. (1985) who found that

80 per cent of parents companies exerted

strong influence over dividend policy and 77

per cent were influential in setting royalty

payments.

Table I also shows the extent to which 指导英国作业

financial decisions are delegated according to

the geographical location of the parent. In

general, subsidiaries of Asian Pacific countries

have greater autonomy with European firms

and US subsidiaries experiencing a much

greater degree of centralised control. For

example, in decisions relating to setting

financial targets, the choice of capital

investment spending and the setting of target

return on investment subsidiaries of Asian

Pacific firms had by far the greatest degree of

independence. However, there were no major#p#分页标题#e#

geographical differences over strategic matters

such as dividend policy.

Marketing and production decisions

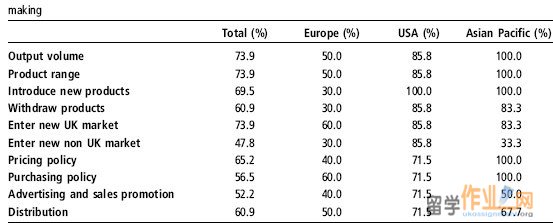

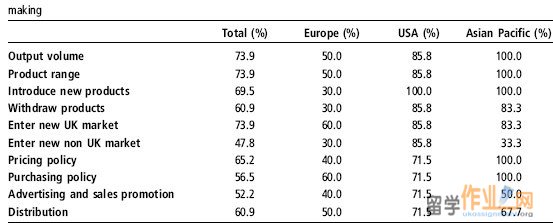

Table II shows that, for the whole sample, the

majority of production and marketing

decisions were delegated to the subsidiary. In

terms of production decisions, subsidiaries

had significant control over the determination

of production output, product range and

deciding to enter new UK markets. In each

case, 74 per cent of subsidiaries had

substantial freedom of action.

Marketing decisions were, however, subject

to a higher degree of centralised control. For

example, fewer than half thought that they

had much control over entering new non-UK

markets and just over a half had control over

advertising and sales promotion. These

results are consistent with Young et al.

(1985).

In relation to distribution, we found that 60

per cent of firms had a degree of

independence, a finding consistent with

Locate in Scotland (1997). However, this is a

significant reduction of independence since

Young et al. (1985) who found that only 5 per

cent of parent companies exerted a strong

influence over distribution decisions. This

finding supports Collins and Schimenner

(1997) who argued that as firms become more

pan-European, marketing and sales decisions

will become more removed from the authority

of the subsidiary.

We found that only 56 per cent of

subsidiaries had some freedom in purchasing

decisions which suggests that MNCs are

adopting global purchasing strategies. This

supports other studies such as Dunning

(1986) and Daniels and Radebaugh (1998).

In terms of geographical differences, Table

II shows that Continental European

subsidiaries have substantially less autonomy

than their Asian Pacific and North American

counterparts. This applies to all production

decisions and is most noticeable in relation to

introducing new products, withdrawing

products and entering new non UK markets

for which only 30 per cent of Continental

European subsidiaries believed they had a

significant degree of autonomy.

Partial support for the Collins and

Schimenner pan-European model can be

shown by the fact that, of the Continental

European MNC subsidiaries in Scotland,

only 30 per cent believed they had the

authority to make decisions about entering

non-UK markets. In contrast their greatest

autonomy related to entering new UK

markets, with 60 per cent believing that they

had a significant degree of independence over

that decision. If the same level of autonomy Table II Marketing and production decisions ± percentage of subsidiaries with substantial autonomy in decision

#p#分页标题#e#

had been demonstrated with regard to

entering new non-UK markets, this would

have been stronger support for the pan-

European model.

Asian Pacific firms also have a considerable

amount of autonomy with regard to the

purchasing policy the subsidiary employs.

This could be a result of increased linkages

with local suppliers in order to maintain a JIT

system (McCalman, 1991).指导英国作业

Advertising and sales promotion was

expected to be more centralised for North

American firms, as US firms are generally

thought to be pursuing global marketing

strategies (Gates and Egelhoff, 1986). This

was not found to be the case, with US firms

having considerable autonomy over this

decision. European parents gave the least

independence to their subsidiaries across

strategic and operational decisions.

Employment and personnel decisions

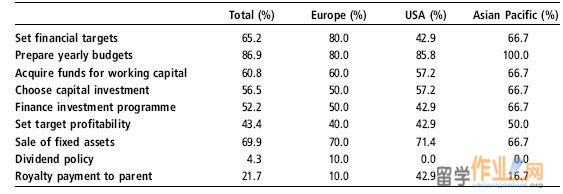

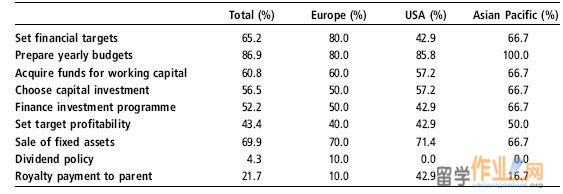

Table III shows that, within the whole

sample, there is significant independence for

subsidiaries. The greatest local independence

related to employment decisions such as the

numbers employed, lay-offs and recruitment

of workers. Wage negotiations were also

subject to significant devolved responsibility.

The results show that for each of the above

decisions, over 90 per cent of subsidiaries

believed they had control over these

operational decisions. The results confirm the

earlier studies of Steuer et al. (1973), Hamill

(1983), Van den Buckle and Halsberghe

(1984) and Young et al. (1985). However, the

recruitment of executives was subject to much

more centralised control with only 43.5 per

cent of subsidiaries having a degree of input

into the decision. This is a further example of

the parent giving extensive delegated

authority over a range of decisions but

maintaining control over decisions which

have strategic implications. Thus decisionmaking

in the subsidiaries is constrained by

the indirect control executives appointed by

the parent company.

There are no real differences in the level of

autonomy of employment and personnel

issues in terms of geographical split. In

general, US subsidiaries have the greatest

autonomy with little difference between the

Asian Pacific and European firms. However,

the greatest control over executive

appointments is found in Asian Pacific parents

with the least control in European parents.

Table II Marketing and production decisions ± percentage of subsidiaries with substantial autonomy in decision

making

Total (%) Europe (%) USA (%) Asian Pacific (%)

Output volume 73.9 50.0 85.8 100.0

Product range 73.9 50.0 85.8 100.0

Introduce new products 69.5 30.0 100.0 100.0

Withdraw products 60.9 30.0 85.8 83.3#p#分页标题#e#

Enter new UK market 73.9 60.0 85.8 83.3

Enter new non UK market 47.8 30.0 85.8 33.3

Pricing policy 65.2 40.0 71.5 100.0

Purchasing policy 56.5 60.0 71.5 100.0

Advertising and sales promotion 52.2 40.0 71.5 50.0

Distribution 60.9 50.0 71.5 67.7

Table III Employment and personnel decisions ± percentage of subsidiaries with substantial autonomy in decision

making

Research and development and

technology

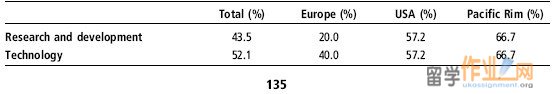

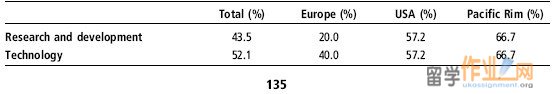

The results of the whole sample show that

56.5 per cent of subsidiaries have significant

control over research and development

decisions. Technology employed decisions

are slightly less devolved with 52.1 per cent of

subsidiaries claiming to have a significant

degree of autonomy.

When compared to the study conducted by

Young et al. (1985), it is apparent that the

MNC subsidiaries autonomy has declined

slightly in these areas. They found that 53 per

cent and 62 per cent of subsidiaries claimed

that they had some degree of autonomy over

research and development and technology

employed decisions, respectively. This result

is consistent with De Meyer and Mizushima

(1989) who argued that centralisation is

important for reasons such as secrecy and the

need to have a critical mass of research and

development staff and facilities in one place.

Overall, the research and development and

technology employed decisions are subject to

substantial parent company control. Given

the increased attention to the ``branch plant''

issue, it is surprising to find that subsidiary

autonomy over these decisions has declined

since Young et al. (1985).指导留学生作业

In terms of the geographical location of the

parent, Table IV shows that there are clear

differences in the autonomy of subsidiaries.

Continental European firms have very little

autonomy with regard to decisions involving

research and development and technology.

This is particularly true of research and

development decisions, where only 20 per

cent of the sample believed that they had a

significant input into the decision process.

This result is substantially lower than both

the North American and Asian Pacific

samples, 57.2 per cent and 66.7 per cent

respectively.

The Continental European sample results

confirm the other results suggesting that they

operate in Scotland in a branch plant manner

with key decisions being mainly dictated by

the parent company. These results confirm#p#分页标题#e#

Yao-Su (1992) who found that German

MNCs tend to locate their research and

development in their home nation.

The majority of North American

subsidiaries have autonomy over both

research and development and technology

employed decisions. This is in contrast to

Bartlett and Ghoshal (1989) who claimed

that American firms are likely to display

characteristics of the co-ordinated federation

organizational form. If this was the case, then

it is likely that the parent company would

have exerted greater influence over

technology decisions within the whole group.

Asian Pacific subsidiaries exhibited the

greatest autonomy with 67 per cent claiming

to have significant degree of independence.

This finding is also contrary to Bartlett and

Ghoshal (1989) who noted that Japanese

firms are likely to display characteristics of the

centralised hub organizational form. If this

was the case then sales, service, distribution

and assembly are more likely to be the scope

of work undertaken by the subsidiary, with

research and development being more

centralised. The results are consistent with

those of De Meyer and Mizushima (1989)

and Papanastassiou and Pearce (1997).

Conclusions

The results shown that subsidiaries do possess

a significant degree of independence over a

large number of decisions. This holds for all

four types of decision analysed ± financial,

production, employment and research and

development. It therefore appears that

concerns about MNC subsidiaries becoming

``branch line'' operations is unfounded.

However, we must look at the types of

decision which have been delegated and

which types have been retained by the parent

before such a conclusion can be justified.

It is clear that parent companies

differentiate between operational and

strategic decisions and that decision making

will be devolved according to which category

of decision is being considered. Operational

decisions in general are delegated whereas

Table IV Research and development and technology ± percentage of subsidiaries with substantial autonomy in

decision-making

strategic decisions tend to be retained under

the control of the parent. For example, in

relation to employment decisions, subsidiaries

have almost total freedom to decide on

worker recruitment, redundancies and local

wage negotiations. These are operational

issues which give the impression of

considerable local autonomy. However,#p#分页标题#e#

decisions involving the recruitment of

executives remains primarily under the

control of the parent. Thus the parent is

ensuring that the highest ranking local office

holders are centrally appointed. Therefore

those responsible for running the subsidiary

will represent the thinking of the parent. This

has strategic implications because it suggests

that, in key decisions, the MNC has the

backing of local senior executives.

A further example of the operational/

strategic distinction is evident by the fact that

financial decisions such as the preparation of

yearly budgets and obtaining funds for

working capital are operational and mainly

the responsibility of the subsidiary. In

contrast, strategic decisions such as dividend

policy and profitability targets are shown to be

centrally determined. 指导作业

It is also apparent that the geographical

location of the parent influences the extent of

autonomy delegated to the subsidiary. In

general, European MNCs retain the greatest

control over operational and strategic

decisions whereas US subsidiaries tend to

have more freedom. These differences relate

mainly to operational decisions given that, as

shown above, parents generally retain control

over strategic decisions.

It therefore appears that subsidiaries are

subject to selective, rather than blanket,

controls. Control is retained over key

decisions. These results are consistent with

the increasing globalisation of markets which

requires firms to pursue common purposes

rather than local objectives. However, it does

still have potentially worrying implications for

the location of, for example, research and

development and other valueadding

functions.

References

Baliga, B.R. and Jaegar, A.M. (1984), ``MNC: control

systems and delegation issues'', in Transnational

Corporations and Business Strategy, Lecrow, D.J.

and Morrison, A.J., (Eds), Routledge, London.

Bartlett, C.A. and Ghoshal, S. (1989), Managing Across

Borders: The Transnational Solution, Harvard

Business Press, Boston, MA.

Christodoulou, P. (1996), Inward Investment: An Overview

of and Guide to the Literature, The British Library,

London.

Collins, R. and Schimenner, R. (1997), ``Pan regional

manufacturing: the lessons from Europe'', in

Mastering Management, Financial Times, Pitman

Publishing, London.

Daniels, D.J. and Radebaugh, L.H. (1998), International

Business ± Environment and Operations, Addison-

Wesley, Reading.

De Meyer, A. and Mizushima, A. (1989), ``Global R&D

management'', R&D Management, Vol. 19,

pp. 135-46.

Dunning, J.H. (1986), Japanese Participation in British#p#分页标题#e#

Industry, Addison-Wesley, Reading

Gates, S.R. and Egelhoff, W.G. (1986), ``Centralization in

headquarter-subsidiary relationships'', Journal of

International Business Studies, Vol. 17, Summer,

pp. 71-93.

Hamill, J. (1983), ``The labour relations practice of foreign

owned and indigenous firms'', Employee Relations,

Vol. 5, pp. 14-16.

Hood, N. and Young, S. (1988), ``Inward investment and

the EC: UK evidence on corporate integration

strategies'', in Dunning, J.H. and Robson, P. (Eds),

Multinationals and the European Community, Basil

Blackwell, Oxford.

Locate in Scotland (1997), Annual Review 1996-1997,

Locate in Scotland publication.

McCalman, J. (1991), ``The Japanese of silicon glen:

implications for spin-off and supplier linkages'',

Fraser of Allander Quarterly Economic Commentary,

Vol. 17, pp. 56-63.

Papanastassiou, M. and Pearce, R.D. (1997), ``Technology

sourcing and the strategic roles of manufacturing

subsidiaries in the UK: local competences and

global competitiveness'', Management International

Review, Vol. 37 No. 1, pp. 5-26.

Steuer, M.D., Abell, P., Gennard, J., Perlman, M., Rees, R.,

Scott, B. and Wallis, K. (1973), The Impact of

Foreign Direct Investment on the UK, Department of

Trade and Industry, HMSO, London.

Van Den Bulcke, D. and Halsberghe, E. (1984),

Employment Decision-Making in MNEs: Survey

Results from Belgium, Multinational Enterprises

Programme, Working Paper No. 32, International

Labour Office, Geneva.

Wind, J. (1997), ``Big question for the 21st century'', in

Mastering Management, Financial Times, Pitman

Publishing, London.

Yao-Su, H. (1992), ``Global or stateless corporations are

national firms with international operations'',

California Management Review, Winter, pp. 107-21.

Young, S., Hood, N. and Hamill, J. (1985), Decision-

Making in Foreign-Owned Multinational

Subsidiaries in the United Kingdom, Multinational

Enterprises Programme, Working Paper No. 35,

International Labour Office, Geneva.

|

#p#分页标题#e#

#p#分页标题#e#