|

The process of issuing securities

发行证劵过程

The issue of shares in an ‘Initial Purchase Offering’ uses an ‘underwriter’ who will take on the risk of the issue

在初始购买发售股份的问题,使用“承销商将采取谁的风险问题

They purchase the shares from the firm, and sell them onto the market at a higher price

他们从公司购买股票,然后高价卖到市场

In return these firms take on the risk of not selling the securities.

作为回报,这些企业采取不卖证券的风险

The costs of finance are obviously increased by the commissions paid to the underwriter

融资成本明显增加支付给承销商的佣金

http://www.ukassignment.org/lxszy/

Costs of finance

金融成本

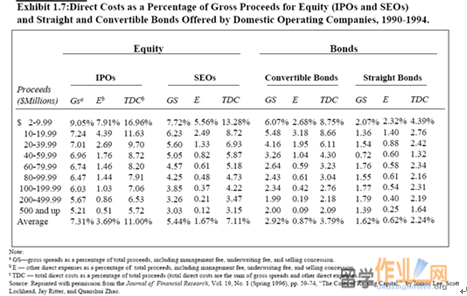

When issuing securities various costs will be incurred:

发行证劵时,将产生各种费用:

Spread

传播

Other direct expenses (registration, etc.)

其他直接费用(登记等)

Indirect expenses

间接费用

Abnormal returns

异常报酬

Underpricing

低价出售

Green shoe option

优先购股权选项

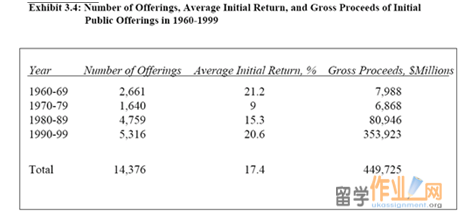

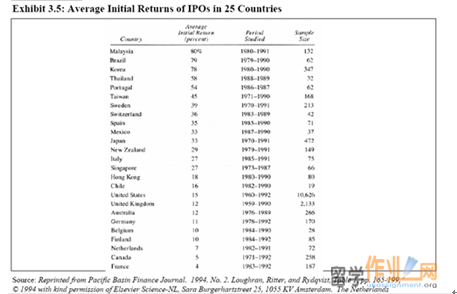

Underpricing of IPOs

IPOs抑价

Shares in IPO issues are frequently sold below value

在首次公开招股发行的股份经常低于价值出售

Partly logical – overpriced issues are unlikely to sell…

部分逻辑——定价过高的问题不太可能出售

But underpricing is a loss to shareholders/firm

但抑价是对股东/公司的损失

Many underpriced issues are in small firms, so presumably unknown and planning riskier expansions – so risk premium or method of attraction (deliberate bargain)

许多定价过低问题是在一些小公司,因此推测未知和规划风险扩张,所以风险溢价或方法的吸引力(故意讨价还价)

This can constitute a significant cost overall

这可以构成一个重大的总体成本

Review

回顾

Stages of finance needs

阶段的融资需求

Debt and equity financing – options and balance

债务和股权融资 - 股权及资产

Equity issues

权益问题

Venture capitalist – more active ownership

创业资本主义 - 更积极的所有权

Activist shareholders

激进股东

Risks of exposure to stock markets

风险暴露于股市

Costs

成本

Sources

Arnold, G. (2005) Corporate Financial Management. (3rd ed., London: FT Prentice Hall) (E658.15 ARN) Chs15, 17, 19

Ross, S.A., Westerfield, R.W., & Jordan, B.D. Fundamentals of Corporate Finance. (McGraw-Hill) Ch.16 Raising Finance

|