|

The value of an efficient market

一个有效市场的价值

•1 To encourage share buying

为了鼓励股份购买

•2 To give correct signals to company managers

对公司经理发出正确的信号

–Managers need to be assured that the implication of a decision is accurately signalled to shareholders and to management through the share price

管理者需要确保,决定的含义是对股东和管理通过股票价格的准确信号

–The rate of return investors demand on securities

投资回报率要求证劵

–Information communicated to the market

信息传达给市场

•3 To help allocate resources

帮助分配资源

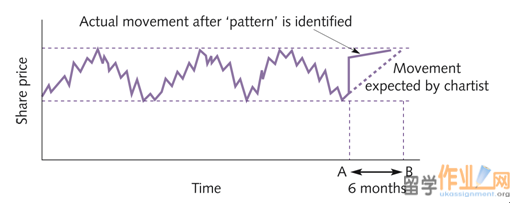

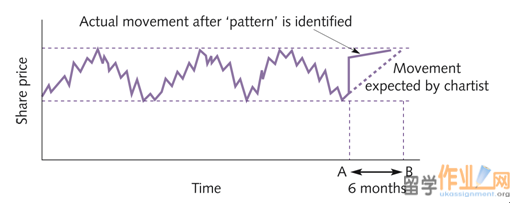

Random walks

随机游走

A share price pattern disappears as investors recognise its existence

一个股票计价模式消失,因为投资者意识到它的存在

The three levels of efficiency

效率三个层次

1 Weak-form efficiency. Share prices fully reflect all information contained in past price movements

弱式效率。股票价格充分反映所有信息包含在过去的价格变动

2 Semi-strong form efficiency. Share prices fully reflect all the relevant publicly available information

半强式效率。股票价格充分反映所有相关公开资料

3 Strong-form efficiency. All relevant information, including that which is privately held, is reflected in the share price

强式有效。所有相关信息,包括其私人持有的,反映在股价

http://www.ukassignment.org/lxszy/

Weak-form tests

弱式测试

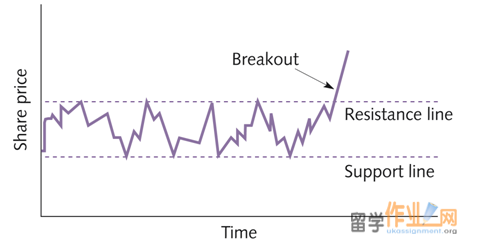

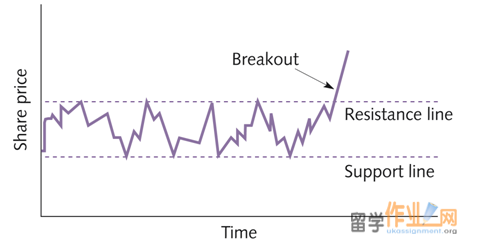

A ‘line and breakout’ pattern

A 线和突破模式

Weak-form tests

弱式测试

•The filter approach

过滤器的方法

–Focus on the long-term trends and to filter out short-term movements

专注于长期发展趋势,并过滤掉短期走势

•The Dow theory

道氏理论

•There will be no mechanical trading rules based on past movements which will generate profits in excess of the average market return (except by chance)

将不会有任何机械交易规则基于过去的走势,将产生的利润超过市场平均回报(除非偶然)

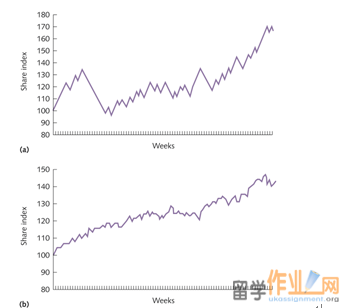

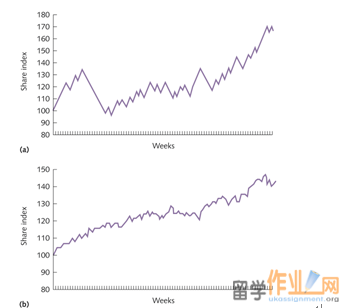

•A simple price chart

一个简单的价格图表

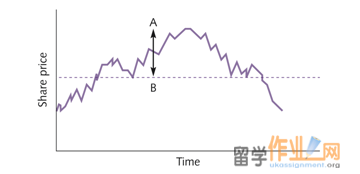

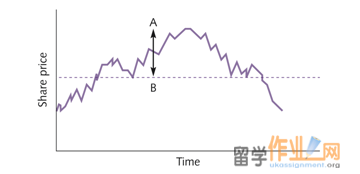

•Head & Shoulder’s pattern

头&肩模式

Weak form efficiency - general conclusion

弱式效率 - 一般结论

• The evidence and the weight of academic opinion is that theweak form of the EMH is generally to be accepted

学术见解的证据和重量是来自有效市场假说弱式是普遍被接受的。

• Benjamin Graham: “One principle that applies to nearly all these so-called ‘technical approaches’ is that one should buy because a stock or the market has gone up and should sell because it has declined… the exact opposite of sound business sense everywhere else… we have not known a single person who has consistently or lastingly made money by thus ‘following the market”’

本杰明•格雷厄姆:“一个原则适用于几乎所有的这些所谓的”技术手段“,是一个人应该买,因为股票或市场已经涨了,应该卖的,因为它已经下降......完全相反的声音无处不在的商业意识否则...我们不知道一个人谁通过这样的“后市场”的一贯持久赚了钱'

|