|

Small firms

小企业

•Studies in the 1980s found that smaller firms’ shares outperformed in the USA, Canada, Australia, Belgium, Finland, the Netherlands, France, Germany, Japan and Britain

在20世纪80年代的研究发现,在美国,加拿大,澳大利亚,比利时,芬兰,荷兰,法国,德国,日本和英国规模较小的公司的股票跑赢大盘。

•Perhaps the researchers had not adequately allowed for the extra risk of small shares, beta

也许研究人员还没有充分允许的额外风险的小型股

•Some researchers have argued that small firms suffer more in recessions

一些研究者认为,小企业在经济衰退遭受更多

•Proportionately more expensive to trade in small companies’ shares

贸易小公司的股份比例更昂贵

•‘Institutional neglect’

“机构疏忽”

http://www.ukassignment.org/lxszy/

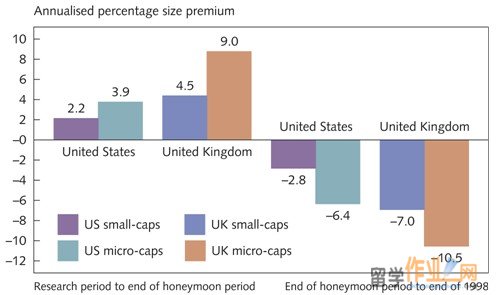

The small-cap reversal in the United States and the United Kingdom

在美国和英国的小盘股反转

Underreaction

反应不足

•Investors are slow to react to the release of information in some circumstances

投资者发布的信息,在某些情况下,反应迟缓

•‘Post-earnings-announcement drift’

'后盈利公布漂移“

•Bernard and Thomas (1989): cumulative abnormal returns (CARs) continue to drift up for firms that report unexpectedly good earnings and drift down for firms that report unexpectedly bad figures for up to 60 days after the announcement.

伯纳德和托马斯(1989):累积异常报酬(汽车)报告意外良好的盈利和公司报告长达60天的意外糟糕的数字公布后漂下来的企业继续漂泊。

•The abnormal return in a period is the return of a portfolio after adjusting for both the market return in that period and risk

在一个周期内的异常回报是在这期间双方的市场回报和风险调整后的投资组合回报率

The cumulative abnormal returns (CAR) of shares in the 60 days before and the 60 days after an earnings announcement

60天前股份累计超额收益率和60天后盈余公告

•Other areas of research into underreaction

其他的研究领域为反应不足

•Ikenberry et al. (1995) share prices rise on the announcement that the company will repurchase its own shares

Ikenberry et al. (1995)公告称公司将重新购回自己的股票股价上升

•Michaely et al. (1995) found evidence of share price drift following dividend initiations and omissions

Michaely et al. (1995)发现股价漂移的证据跟随股息的开启和遗漏

•Ikenberry et al. (1996) found share price drift after share split announcements

Ikenberry et al. (1996)发现拆股公告后股价漂移

•Jegadeesh and Titman (1993) found that trading strategies in which the investor buys shares that have risen in recent months produce significant abnormal returns

Jegadeesh和蒂特曼(1993)发现,投资者购买股份已在最近几个月上升的交易策略产生显着的异常报酬

•Chan et al. (1996) confirm an underreaction to past price movements (a ‘momentum effect’) and also identify a drift after earnings surprises

Chan et al. (1996)确认反应不足以往的价格走势(动量效应'),还确定后漂移盈利惊喜

|