|

WACC

加权平均资本成本

• Calculating the weights

计算权重

– Book (accounting) values for debt, equity and hybrid securities should not be used in calculating the weighted average cost of capital. Market values should be used

债券的书(会计)值,股票和混合型证券不应该被用于计算加权平均资本成本。应使用市场价值

– Market capitalisation figure are available in Monday editions of the Financial Times for quoted companies – also websites

市值数字是上市公司的“金融时报”周一的版本 - 网站

• The WACC with three or more types of finance

加权平均资本成本有三个或更多类型的金融

• Classic error: managers are sometimes tempted to use the cost of the latest capital raised to discount projects, SBUs, etc

经典的错误:管理者有时想使用折扣项目,事业部等提出的最新资本成本

• What about short-term debt?

短期债务怎么样?

– Should be included

应包括

– However, to the extent that this debt is temporary or offset by cash and marketable securities it may be excluded

然而,的程度,这是暂时的还是债务抵消的现金和有价证券,它可能会被排除在外

Finance and operating leases

融资及经营租赁

http://www.ukassignment.org/lxszy/

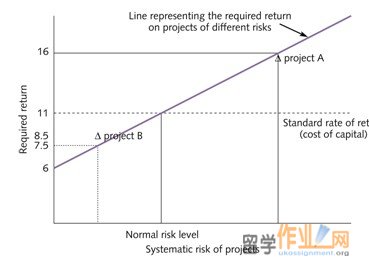

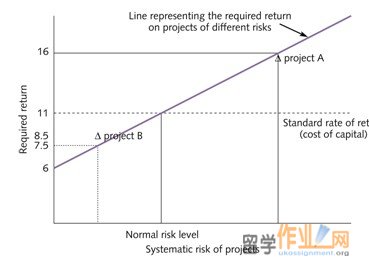

Rates of return for projects of different systematic risk levels

为不同的系统风险水平的项目的回报率

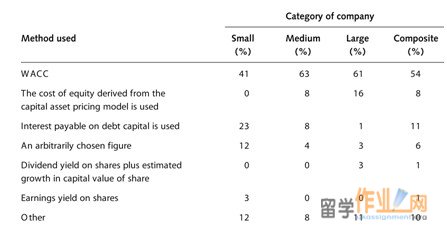

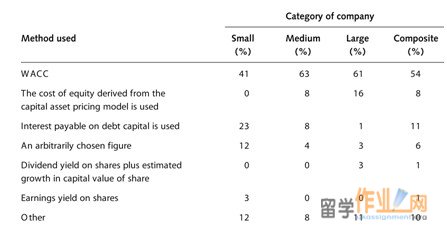

Empirical evidence of corporate practice

企业实践的实证证据

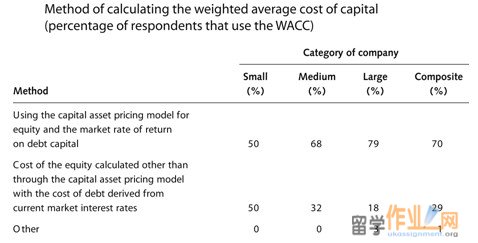

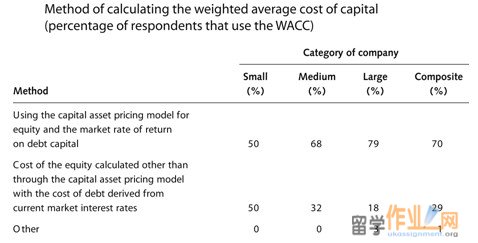

Method of calculating the weighted average cost of capital (percentage of respondents that use the WACC)

计算加权平均资本成本法(使用加权平均资本成本的受访者百分比)

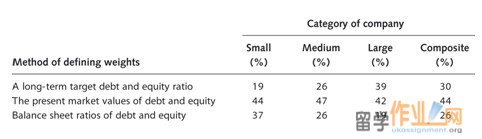

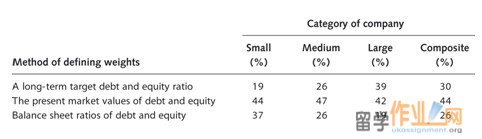

If the weighted average cost of capital is used, then how are the weights defined? (percentage of respondents)

如果按加权平均资本成本,那么如何定义的权重呢? (受访者百分比)

Implementation issues

实施问题

How large is the equity risk premium?

股权风险溢价有多大?

• The equity risk premium is a subjective estimate.

股权风险溢价是一个主观的估计。

• In using historic data we are making at least two implicit assumptions:

在使用历史数据,我们至少有两个隐含的假设:

– There has been no systematic change in the risk aversion of investors over time.

一直没有系统性的变化,随着时间的推移,投资者的风险厌恶情绪。

– The index being used as a benchmark has had an average riskiness that has not altered in a systematic way over time.

该指数作为基准的平均风险程度,随着时间的推移有系统的方式没有改变。

• Differing views

不同观点

– Some City analysts

– Plump for 2 per cent

– Barclays Capital around 4 per cent, Competition Commission 3.5 and 5 per cent, Ofgem 2.5 per cent to 4.5 per cent.

Implementation issues

实施问题

How reliable is CAPM’s beta?

CAPM模型的测试的可靠性如何?

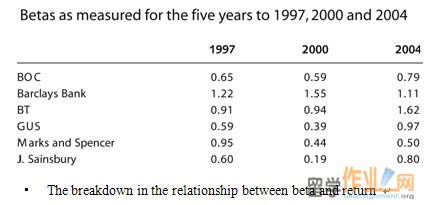

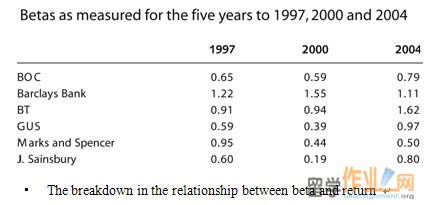

The use of historic betas for future analysis

• The breakdown in the relationship between beta and return • The breakdown in the relationship between beta and return

Fundamental beta

基础测试

1 The type of business that the company (SBU or project) is engaged in

该公司的业务类型(SBU或项目)是一家从事

2 Degree of operating gearing

资产负债经营程度

3 Degree of financial gearing

财务杠杆程度

Some thoughts on the cost of capital

资本成本的一些看法

• Progress

进展

• Outstanding issues

未决问题

– The current risk-free rate is the bedrock

当前的无风险利率是基岩

– Return should be increased to allow for the risk of a share with average systematic risk

返回应增加,使A股的风险与系统性风险平均

– Risk premium increased or decreased depending on the company’s systematic risk level

风险溢价增加或减少取决于对公司的系统性风险水平

• Major difficulty calculating the systematic risk level

• 计算系统风险水平的主要困难

|

• The breakdown in the relationship between beta and return

• The breakdown in the relationship between beta and return