|

Return reversal

返回逆转

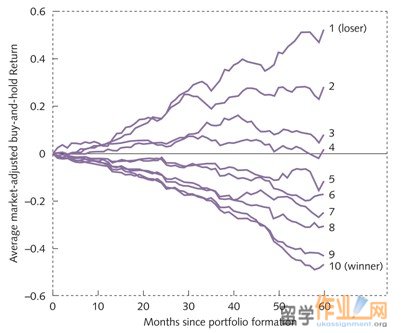

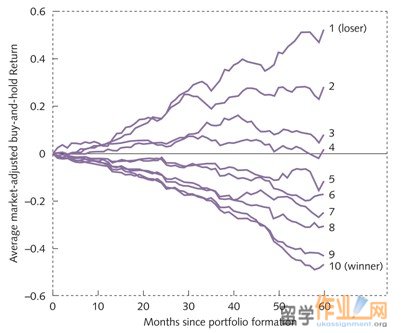

•De Bondt and Thaler (1985)

–Shares that had given the worst returns over a three-year period outperformed the market by an average of 19.6 percent in the next 36 months

•Chopra et al. (1992)

–Extreme prior losers outperform extreme prior winners by 5–10 per cent per year during the subsequent five years

•Arnold and Baker (2005)

–Loser shares outperformed winner shares by 14 percent per year

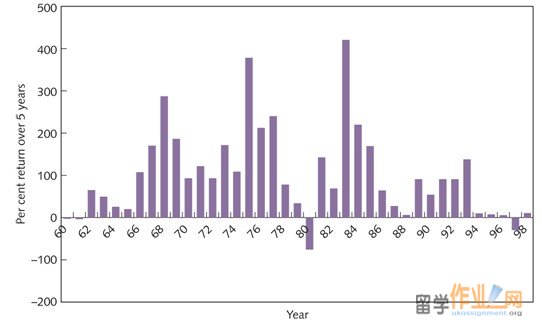

Cumulative market-adjusted returns for UK share portfolios constructed on the basis of prior five-year returns

英国的份额组合的市场调整后的回报累积构建的前五年回报基础上

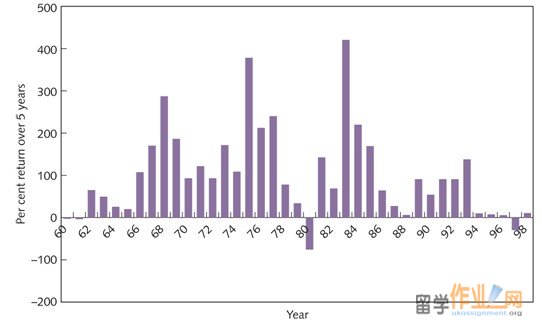

Market-adjusted buy-and-hold five-year test-period returns for loser minus winner strategies for each of the 39 portfolio formations

市场调整后买入并持有五年的39个投资组合编队为每个测试期间回报为失败者减去赢家策略

Price (return) momentum

价格(返回)势头

Jegadeesh and Titman (1993): a strategy that selects shares on their past six-month returns and holds them for six months, realises a compounded return above the market of 12.01 per cent per year on average

Jegadeesh and Titman (1993): 在他们过去六个月选择股票的战略汇报并持有6个月,实现了高于市场平均每年12.01%的复利回报。

•Possible explanations:

可能的解释:

–Investors underreacting to new information

投资者对新消息反应不够有力

–Investors overreacting during the test period

投资者在测试期间反应过度

•Rouwenhorst (1998) showed price momentum in 12 developed country stock markets

Rouwenhorst(1998)显示在12个发达国家股市呈现上涨势头

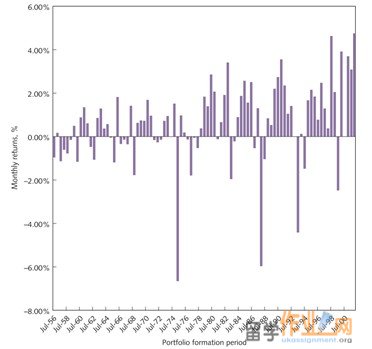

•Liu et al. (1999)

•Hon and Tonks (2003)

•Arnold and Shi (2005)

–Tested the strategy over the period 1956 to 2001

测试战屡经过1956到2001

•While on average, winners outperform losers by up to 9.92 percent per year the strategy is fairly unreliable

虽然平均而言,获奖者跑赢失败者高达每年9.92%的策略是相当不可靠的

http://www.ukassignment.org/ygkczy

Price momentum

价格动量

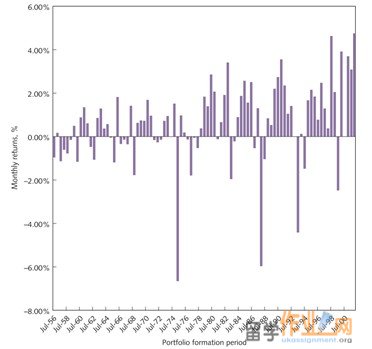

Portfolios are constructed on six-month prior-period returns and held for six months. Buy-and-hold monthly returns over the six months for the winner portfolio minus the loser portfolio. Each portfolio formation is shown separately

6个月期的前期回报的投资组合构建,并为6个月内举行。买入并持有超过6个月,每月回报的赢家组合减去失败者组合。单独显示每个组合形成。

Moving averages

移动平均线

•Brock et al. (1992)

•If investors (over the period 1897 to 1986) bought the 30 shares in the Dow Jones Industrial Average when the short- term moving average of the index (the average over, say, 50 days) rises above the long-term moving average (the average over, say, 200 days) they would have outperformed the investor who simply bought and held the market portfolio

如果投资者(1897年至1986年)在此期间买了30股,短期均线的指数(平均了过来,说,50天)上升时,道琼斯工业平均指数高于长期移动平均线(在平均以上,也就是说,200天),他们将跑赢投资者只需购买和持有市场组合

•However, transaction costs should be carefully considered before such strategies can be implemented’ (Brock et al.1992)

然而,交易成本,应仔细考虑才可以实现这种战略'(Brock et al.1992)

•The trading rules did not work in the 10 years following the study period (Sullivan et al. 1999)

交易规则没有工作10年后,研究期间(Sullivan等。1999)

|