|

How pension policies affect individual behaviour

There are two financing schemes in basic pension, so we need to discuss them separately.

Use Feldstein’s approach, we now explore the impact of fundamental pension that based on PAYG DB scheme.

Fundamental pension does not require individual contribution, and encourage people working longer. In terms of fundamental pension alone, for an individual who in the absence of pension plan would have retired after legal age anyway, fundamental pension have no effect on personal savings behaviour. For those who in the absence of pension plan would otherwise have work beyond legal retirement age, fundamental pension may induce them postpone retirement, and it is possible to decrease personal savings. For some individuals who would work beyond retirement age anyway, it will be the same case.

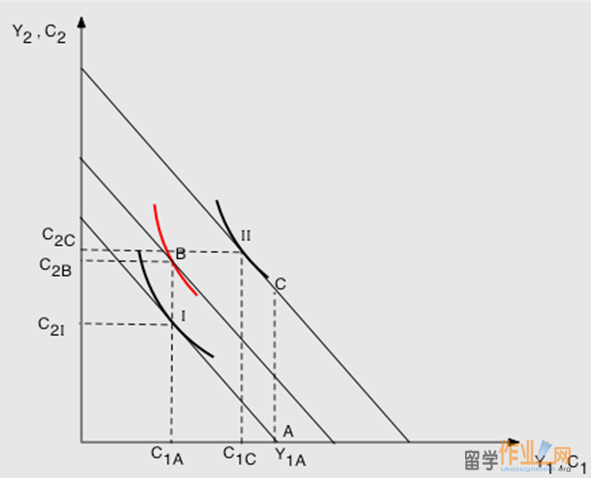

Figure 6: Lifetime consumption plan

The figure shows the influence of fundamental pensions. The X-axis measures income and consumption before retired, and Y-axis measures income and consumption after retired. For an individual who in the absence of fundamental pension would have retired after legal age, he has initial point A (there is no income and consumption after retired), and he chooses an equilibrium point I on a budget constraint through point A. At this point, his consumption of period one is C1A, and has savings of C1A~Y1A. After he join in pension plan, his consumption of period one remains unchanged due to he does not pay any contributions. The available consumption point is on the horizontal line through point I. He cannot reach the new equilibrium level due to the income and consumption of period one remains unchanged.

Another situation of individual choice is been induced to postpone retirement. In this case, things are different. Because he is possible retired after legal age, we denote his initial point by C on the horizontal line through point A. It means he will have income during period two whether he has savings or not. The new budget constraint through point C with same slope of previous budget constraint. New equilibrium level of new budget constraint is denoted by II. Individual still work during period two, thus it indirectly increases the income of period one. Assuming he reaches the new equilibrium level (it is possible but not always), the new consumption point is C1C, and personal saving decreases from C1A~Y1A to C1C ~ Y1A. In short, if individuals postpone retirement, the personal savings might be decreased. It depends on personal choice whether he is a borrower or lender. Nevertheless, fundamental pension never increase personal savings. About individual account, it is based on Fully Funded DC system, and actually is a mandatory type of personal savings. In theory, it is keeping increase personal savings. However this is a long-term savings plan and the present investment return rate is not ideal. When people loss faith on it, they will simply find anyway to escape of making payment to contribution.

Overall, pension system itself does not have absolutely impact on personal behaviour. The actual situation still relies on personal preference. China’s pension policy emphasis on principle of “the more you do, the more you gain”. It should be very attractive and theoretically should have higher coverage, but things are more complicated in China. Social security is a long-term plan, thus only people with average income have more interesting. The group of average income level called middle class. This group have stable job and stable future. They have relatively fixed pattern of income and consumption. Only in this class, people feel attractive with predictable long-term social security plan. However, China’s social class is not like an average olive figure. The olive theory means, a health security should have very small group of both extreme rich people and extreme poor people, like olive’s two ends. Majority personal should have average income like olive’s middle part. China has just the opposite situation: large ends and small middle. Too many rich people and too many poor people, except very few of average income people. Poor people do not interest in long-term plan due to they do not even have enough money from today’s meal. Rich people would not have interesting neither since they do not care about a little investment return. Under such social structure, social security system discussion cannot conclude valuable results, because lost of people do not really care.

Therefore, two different pension lines in urban and rural areas are consistent with national conditions. The big pension gap between rural and urban is inevitable until rural area have a great economic development. On the urban pension side, the way of guaranteed real individual accounts is the best option to deal with aging population. Other improvements should be down are increasing investment return rate of individual accounts funds, constantly doing real accounts to strengthen the confidence of pensioners. So that people would be more willing to join the pension plan, which can expand coverage and speed up the development the occupational pension.

|

|

|||

| 网站地图 |